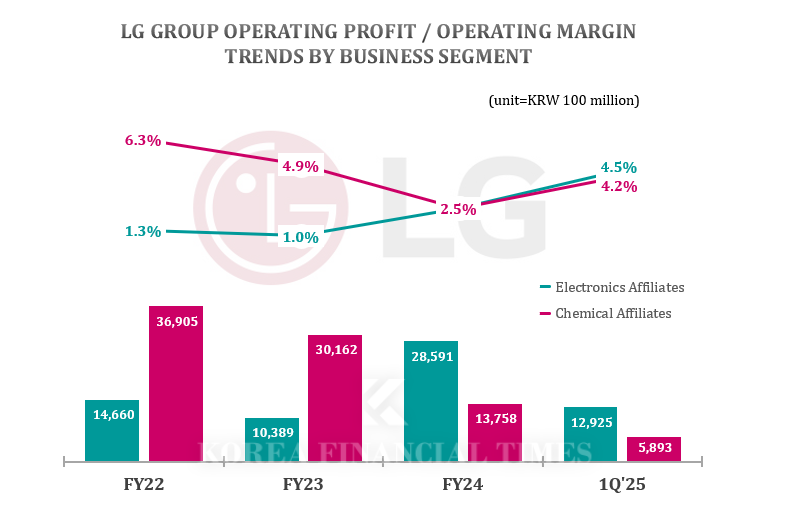

In particular, the profitability defense of the electronics affiliates stands out compared to the struggling chemical sector.

Specifically, electronics affiliates such as LG Electronics, LG Display, and LG Innotek recorded a combined Q1 revenue of KRW 28.8041 trillion and an operating profit of KRW 1.2925 trillion. The operating margin was 4.5%. The annual operating margins for LG's electronics affiliates were 1.3% in 2022, 1.0% in 2023, and 2.5% in 2024.

The reason for the rebound in operating margin is the turnaround to profitability by LG Display. LG Display swung from an operating loss of KRW 469.4 billion in Q1 last year to an operating profit of KRW 33.5 billion in Q1 this year. This is the first quarterly profit for the company in three years.

* Electronics Affiliates = LG Electronics (including LG Innotek), LG Display / * Chemicals Affiliates = LG Chem (including LG Energy Solution), LG Household & Health Care

이미지 확대보기Chemical affiliates such as LG Chem, LG Household & Health Care, and LG Energy Solution posted a combined revenue of KRW 13.8689 trillion and operating profit of KRW 589.3 billion. The operating margin was 4.2%, lagging 0.3 percentage points behind the electronics affiliates. It is positive that they succeeded in rebounding their profitability. The annual operating margins for chemical affiliates were 6.3% in 2022, 4.9% in 2023, and 2.5% in 2024, showing a downward trend.

This was largely due to the operating profit of LG Energy Solution, which increased 138% from KRW 157.3 billion in Q1 last year to KRW 374.7 billion in Q1 this year.

However, the operating profit of LG Energy Solution includes a KRW 457.7 billion tax credit from the U.S. IRA. Excluding the subsidy, the company actually posted an operating loss of KRW 83 billion, which remains a concern.

LG Chem also saw its core petrochemical division's operating loss widen to KRW 56 billion, about double from a year earlier. Despite cost-cutting efforts, factors such as rising electricity rates contributed to the deterioration in profitability.

Meanwhile, LG Group has decided not to hold its annual strategy briefing, usually chaired by Chairman Koo Kwang-mo in the first half of the year to review future strategies. It is assessed that this decision reflects Chairman Koo's judgment that, amid growing global uncertainties, it is more necessary to swiftly execute existing strategies rather than discuss new ones.

LG Chem also saw its core petrochemical division's operating loss widen to KRW 56 billion, about double from a year earlier. Although cost-saving efforts were made, the company explained that factors such as rising electricity prices contributed to the deterioration in profitability.

Meanwhile, LG Group has decided not to hold its annual strategy briefing, usually chaired by Chairman Koo Kwang-mo in the first half of the year to review future strategies. It is assessed that this decision reflects Chairman Koo's judgment that, amid growing global uncertainties, it is more necessary to swiftly execute existing strategies rather than discuss new ones.

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)