As the group celebrates its 40th anniversary this year, it stands at a critical juncture for a quantum leap. This is because challenges persist, including the impact of U.S. tariffs continuing from last year, the EV chasm, and intensifying competition in future mobility such as autonomous driving and SDV (Software-Defined Vehicles).

Chairman Chung Eui-sun plans to defend sales volume and profitability by expanding local U.S. production and broadening the electrification lineup including hybrids (HEV) this year. In the future mobility sector, the group will invest USD 26 billion over approximately four years to enhance technological capabilities and accelerate commercialization.

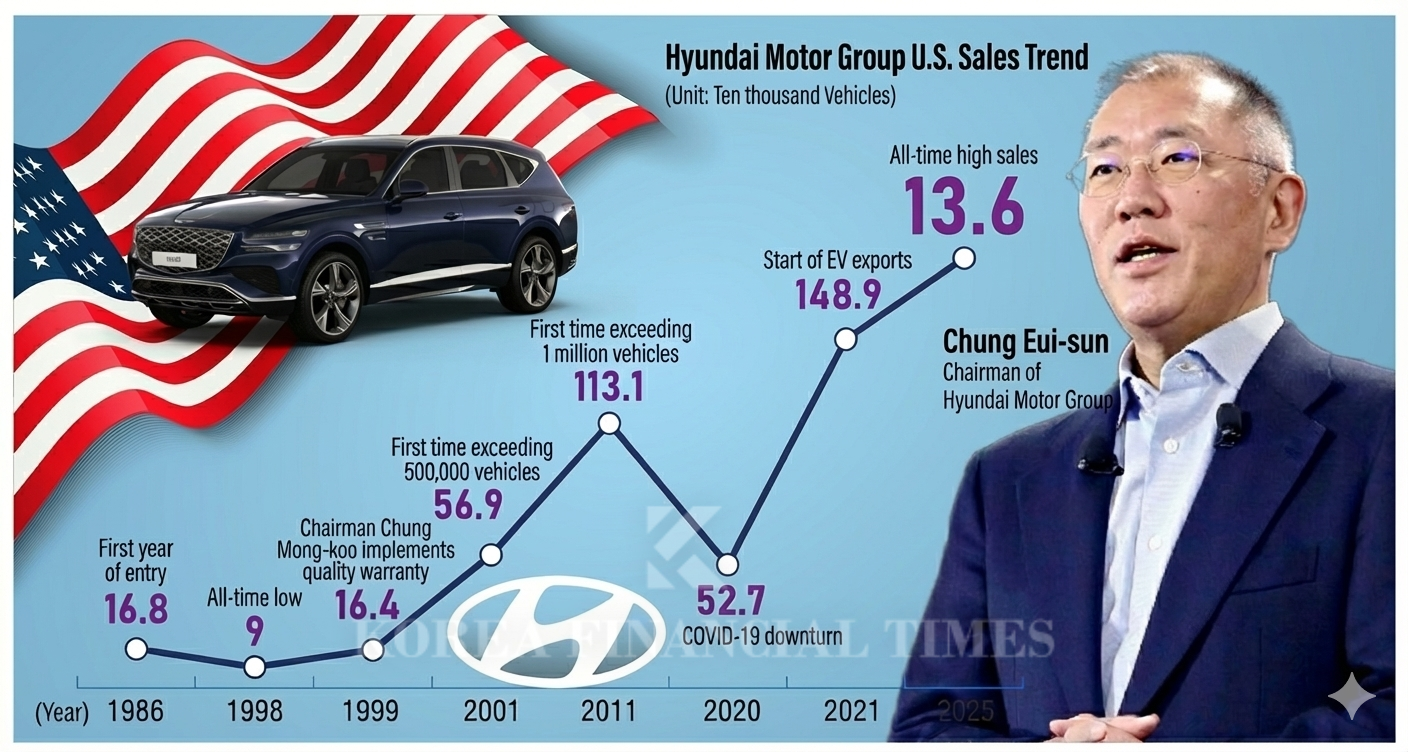

According to Hyundai Motor Group, combined U.S. sales of Hyundai Motor and Kia last year reached 1,836,172 units, up 7.5% year-over-year, recording the highest sales ever. The group has continued its streak of breaking all-time sales records for five consecutive years since approximately 1.48 million units in 2021.

Notably, last year's U.S. sales for Hyundai Motor and Kia showed balanced growth across brands, including Genesis as well as eco-friendly electrification lineups encompassing EVs and HEVs.

Genesis sold 82,331 units in the U.S. last year, up 9.8% year-over-year.

This marks another record-breaking achievement following last year. The eco-friendly electrification lineup also recorded its highest ever at 434,725 units sold last year, up 25.5% year-over-year.

HEV sales, for which demand has increased due to the recent EV chasm, also achieved all-time high sales of 331,023 units.

This signifies that Hyundai Motor Group has established itself as a top-tier brand with global-level technology and competitiveness in luxury and electrification. Recalling the early days of U.S. entry when it was stigmatized as "cheap cars, Hyundai," this represents remarkable growth over approximately 40 years.

Create an English graphic using Gemini based on the original graphic produced by Korea Financial Times

이미지 확대보기From Pioneer Chung Ju-yung's Challenge to the Excel Export Success

Hyundai Motor Group began local sales in 1986 by first exporting the Excel, produced at the Ulsan plant, to the United States. The Excel was the successor model to the Pony, the first vehicle independently produced by Hyundai Motor Group.Hyundai Motor Group's U.S. entry was rooted in the late Chairman Chung Ju-yung's pioneering spirit. He compared the nation to the human body, emphasizing that "roads are like blood vessels and automobiles are the blood flowing through those vessels." Based on the confidence gained from building highways amid the ruins of the Korean War, his determination to succeed in the automotive industry was stronger than anyone else's.

However, despite its low price, the Excel failed to sustain its momentum due to frequent breakdowns and quality issues. As a nascent company, Hyundai Motor Group faced difficulties due to technological competitiveness issues and inadequate local service infrastructure.

Chung Mong-koo's Quality Management and the "10-Year/100,000-Mile Warranty" Gamble

Hyundai Motor Group's U.S. challenge reignited during Honorary Chairman Chung Mong-koo's era. In particular, Chairman Chung Mong-koo made a bold move with the "10-year/100,000-mile warranty" while putting "quality management" at the forefront. Considering that U.S. companies like GM and Ford offered 3-year/36,000-mile warranties and Japan's Toyota provided 5-year/60,000-mile coverage at the time, this was a groundbreaking policy.Thanks to this, Hyundai Motor Group succeeded in restoring local consumer trust. In fact, Hyundai Motor Group remained in the bottom tier among approximately 30 brands in JD Power surveys until the 1990s, but in the 2000s when Chairman Chung Mong-koo took the helm, it leaped to mid-tier status at around 15th place.

In 2005, Chairman Chung Mong-koo also devoted efforts to establishing a local production system by launching Hyundai Motor's first U.S. production facility, the Alabama plant. This move is evaluated as having laid the groundwork for Hyundai Motor Group to take another leap forward in the United States.

Chung Eui-sun's Global Strategy and the Quantum Leap Challenge

Following Chairman Chung Mong-koo, Chairman Chung Eui-sun, who leads Hyundai Motor Group, has grown Hyundai Motor into a complete global top-tier automaker through swift responses to global trend changes. He has not only enhanced the group's image through Genesis but also completed a high-value-added product-centered portfolio including SUVs and electrification lineups that have now become mainstream.As he commemorates the 40th anniversary of U.S. entry this year, Chairman Chung Eui-sun is aiming for another quantum leap. However, significant challenges lie ahead. In particular, there is an assessment that the eco-friendly electrification and future mobility strategies on which Chairman Chung Eui-sun has focused are now facing a full-scale test.

First, this year in the U.S., in addition to the tariff impacts continuing from last year, the EV subsidy policy that ended in October last year and the EV chasm are requiring automakers to reorganize their electrification strategies.

Hyundai Motor Group is first accelerating expansion of local U.S. production.

To this end, the group plans to speed up operations at its two U.S. production facilities: the Alabama plant and Hyundai Motor Group Metaplant America (HMGMA). In particular, the group plans to expand HMGMA's annual production capacity, which can produce both EVs and hybrids on mixed lines, from the current 300,000 units to 500,000 units by 2028.

Along with this, the group will expand its lineup based on electrification powertrain technology covering all areas including HEV, local strategic EVs, and extended-range electric vehicles (EREV).

By 2030, the group will establish a lineup of more than 18 HEV models and expand local U.S. production to pursue achievement of 5.55 million global vehicle sales. The policy is to actively expand local investments for this purpose.

Genesis plans to launch the group's first rear-wheel drive (RWD)-based luxury hybrid vehicle and subsequently pursue development of reasonably priced entry-level hybrids.

In particular, Hyundai Motor began introducing next-generation hybrid systems starting with the Palisade launched in the U.S. last year and plans to provide improved driving performance and fuel efficiency by expanding this application.

Additionally, the company plans to present consumers with diverse electrification experiences such as "Stay mode," which allows electricity use without engine ignition by utilizing high-voltage hybrid batteries, and V2L (Vehicle To Load) functionality.

Competitiveness in future mobility such as autonomous driving and SDV is also a major concern. The U.S. is the largest battleground, home to autonomous driving competitors including Tesla, Google's Waymo, and Amazon-affiliated Zoox.

Hyundai Motor Group also has the headquarters of Motional and other autonomous driving specialist affiliates based in the United States.

As Tesla recently began commercializing Level 3 "FSD (Full Self-Driving Supervised)," Hyundai Motor Group faces urgent pressure. Hyundai Motor plans to unveil an SDV pacecar equipped with the latest autonomous driving technology mid-year and announce specific commercialization plans.

Along with this, autonomous driving affiliate Motional is also accelerating commercialization of autonomous driving-based "robotaxis" locally in the U.S. Motional, together with Hyundai Motor Group, recently showcased a robotaxi developed based on the IONIQ 5 at CES 2026 held in the United States.

The IONIQ 5 robotaxi is Motional's first commercial driverless autonomous vehicle and is scheduled to be fully deployed this year in ride-hailing services for general passengers in Las Vegas, U.S.

The IONIQ 5 robotaxi incorporates autonomous driving technology jointly developed by Hyundai Motor Group and Motional, which is known to be at Level 4 according to Society of Automotive Engineers (SAE) standards. Level 4 means that the vehicle's automated system perceives and judges situations to drive, and the vehicle can respond on its own without driver intervention even in emergencies.

Meanwhile, Chairman Chung Eui-sun stated that the group will invest USD 26 billion in the U.S. market and expand cooperation with leading U.S. companies in future new technology fields such as AI and autonomous driving.

Additionally, from this year through 2030, the company plans to accelerate future technology research by making an unprecedented maximum investment totaling KRW 125.2 trillion domestically.

Kim JaeHun (rlqm93@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)