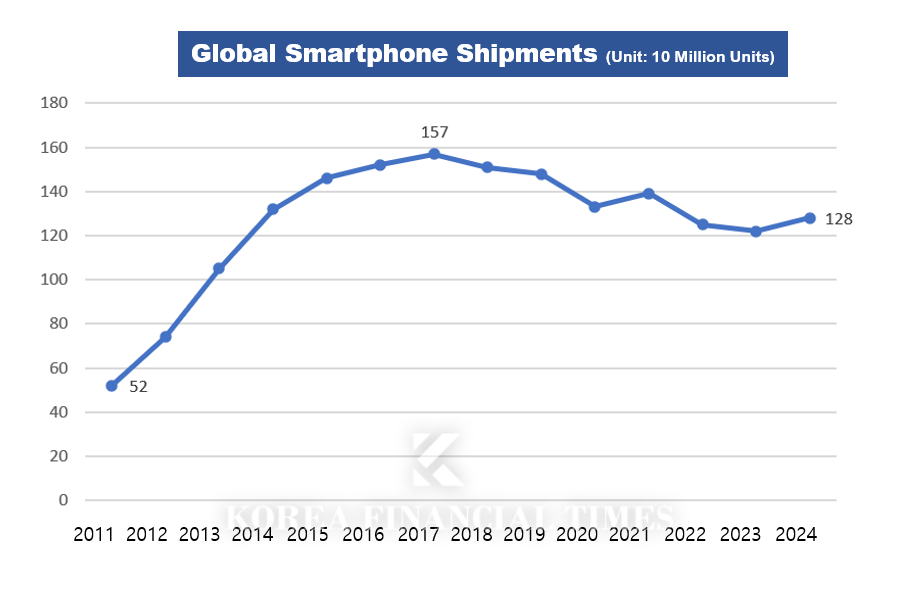

The global smartphone market has been in a prolonged slump for eight years. According to market research firm Counterpoint Research, global smartphone shipments peaked at 1.57 billion units in 2017 and dropped to 1.28 billion units by 2024. With smartphone penetration in major global markets nearing saturation and technology reaching maturity, replacement cycles continue to lengthen.

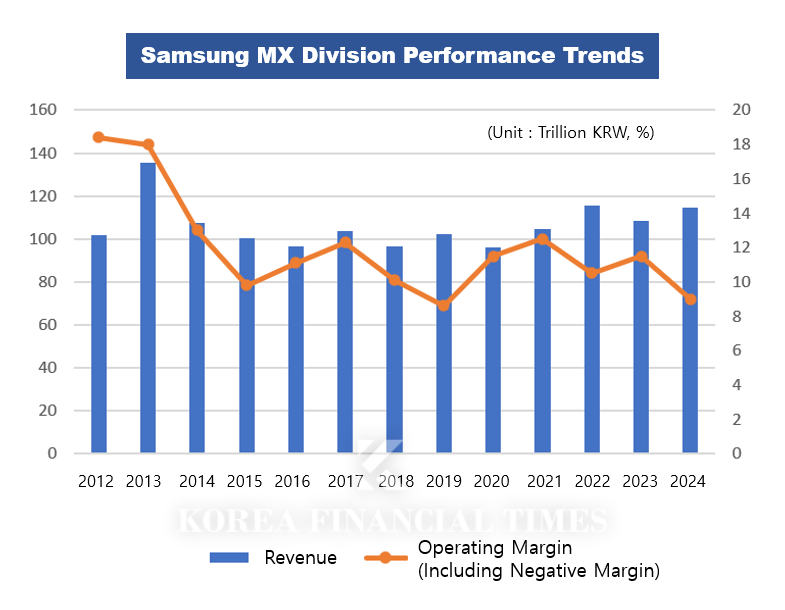

Operating profit margins (including the Network Business Division) reached 18% during the global success of the Galaxy S2, S3, and S4 from 2011 to 2013, but dropped to 9% last year. It is the first time in five years that the margin has fallen to single digits, since the large-scale restructuring (personnel realignment) in 2019, when it was 8.6%.

Roh Tae-moon,President of Samsung Electronics

Roh Tae-moon, who has led the MX Division since 2020, has emphasized “the best of the best, the ultimate premium.” The strategy is to boost profitability by focusing on the premium segment, rather than competing in the mid- to low-end market where Chinese rivals are strong.

On the hardware front, Samsung attempted to expand form factors with foldable phones, launching the Galaxy Fold (unfolds horizontally) in 2019 and the Galaxy Flip (folds vertically) in 2020. However, these have not replaced conventional smartphones. When folded, the devices are thick and less portable, and durability issues have arisen. Samsung Electronics aims for a turnaround with the launch of the Fold and Flip 7 on July 9, which are expected to be the thinnest foldable phones in the company’s history.

Software remains a key challenge. In particular, the level of collaboration with other companies on AI services is emerging as a critical issue. Building in-house AI can help reduce costs, but such a strategy risks limiting functionality compared to external innovations—potentially compromising the user experience.

Currently, Samsung Electronics is pursuing a fundamentally closed AI strategy. The company has equipped its smartphones with “Galaxy AI” starting with the Galaxy S24, based on its own large language model “Gauss,” enabling on-device processing via built-in chips.

In addition, Samsung has adopted a hybrid approach, allowing access only to external AI services that the company has specifically approved. This leaves the door open for potential collaboration with “AI giants.”

Even Apple Inc., which prefers a closed proprietary ecosystem from the operating system (OS) level, appears to be feeling the pressure. Recent foreign media reports indicate that Apple is considering integrating OpenAI’s GPT and Anthropic’s Claude models into Siri.

Previously, Apple announced at the Worldwide Developers Conference (WWDC 2025) last month that upgrades to Siri would be postponed until next year.

An industry official commented, “Apple’s delay in unveiling Siri AI appears to be due to the model’s performance not meeting standards. Samsung Electronics will also inevitably have to consider external partnerships.”

Gwak Horyung (horr@fntimes.com)

![[DCM] 증권사 자기매매, NH·하나 ‘불안’ VS 미래에셋·메리츠 ‘안정’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260310021218082100a837df6494123820583.jpg&nmt=18)

![함영주號 하나금융, 사외이사 1명 교체...소비자보호 전문가 선임 [2026 금융사 주총 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013119503707574b4a7c6999c121131189150.jpg&nmt=18)

![이사진 확대·IT전문가 추천···황병우號 iM금융, 지배구조 개선 '박차' [2026 주총 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030922291501594b4a7c6999c121131189150.jpg&nmt=18)

![평범한 돼지가 호랑이를 물다…미국 AI 왕좌 흔든 中 딥시크 [전병서의 中 첨단기업 리포트②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030610175707018c1c16452b012411124362.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)