The three major credit rating agencies simultaneously downgraded the credit ratings of both Lotte Corporation and Lotte Chemical./Photo courtesy of Lotte Property & Development.

According to industry sources on July 1, Korea Investors Service, Korea Ratings, and NICE Investors Service downgraded Lotte Chemical’s credit rating on June 30, citing operating losses, and simultaneously lowered Lotte Corporation’s rating as well.

Holding Company Downgraded in Tandem with Chemical Unit’s Troubles

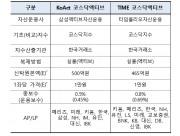

Korea Ratings downgraded Lotte Chemical’s corporate credit rating from AA (Negative) to AA- (Stable), and Lotte Corporation’s unsecured bond and commercial paper ratings from AA- (Negative) to A+ (Stable) and from A1 to A2+, respectively.Korea Investors Service also downgraded Lotte Chemical and Lotte Corporation’s unsecured bond ratings from AA (Negative) to AA- (Stable) and from AA- to A+ (Stable), respectively. NICE Investors Service lowered Lotte Chemical’s long-term credit rating from AA (Negative) to AA- (Stable) and Lotte Corporation’s long- and short-term ratings from AA- (Negative) to A+ (Stable) and from A1 to A2+.

The agencies explained that Lotte Corporation’s consolidated credit rating is calculated as a weighted average of the standalone credit profiles of its core subsidiaries: Lotte Shopping, Lotte Chemical, Lotte Wellfood, and Lotte Chilsung Beverage. The downgrade of Lotte Chemical, which carries a high weighting, directly affected the group’s overall rating.

NICE Investors Service commented, “Lotte Chemical accounts for 43% of Lotte Corporation’s consolidated assets, 49% of sales, and 34% of total debt on a three-year average, making its credit profile a critical factor in the holding company’s overall rating.”

Lotte Chemical and Lotte Corporation both experienced downgrades last year as well, with Lotte Chemical’s unsecured bond rating dropping from AA+ (Negative) to AA (Stable) and Lotte Corporation’s from AA (Negative) to AA- (Stable). The main reason in both years was Lotte Chemical’s weak performance, which again dragged down the holding company’s rating.

Lotte Corporation’s Restructuring Across All Business Sectors

Credit rating agencies noted that for Lotte Corporation’s rating to recover, it will need to strengthen its own financial structure and see improved credit profiles at key subsidiaries such as Lotte Chemical and Lotte Shopping.Since last year, Lotte Corporation has focused on securing financial soundness by divesting non-core businesses and assets across the group.

At the 2025 H1 Value Creation Meeting, Chairman Shin Dong-bin emphasized, “In difficult times, we must overcome challenges by efficiently utilizing the group’s assets through selection and concentration.” The group has since accelerated its efficiency drive.

Lotte Chemical secured about KRW 97.9 billion this year by selling its entire 75.01% stake in its Pakistan-based PTA subsidiary, LCPL. In March, it sold its 4.9% stake in the Japanese company Resonac for KRW 275 billion, earning a total profit of about KRW 80 billion including dividends. The company also raised about KRW 1.3 trillion through price return swap (PRS) contracts on shares in its Indonesian and U.S. subsidiaries. Lotte Chemical liquidated its Malaysian synthetic rubber subsidiary, LUSR, and sold its water treatment membrane plant last month.

Elsewhere in the group, Lotte Wellfood sold its Jeungpyeong plant and Korea Seven’s ATM business in February. In March, Hotel Lotte and Busan Lotte Hotel signed a contract to sell a 56.2% stake in Lotte Rental to Affinity Equity Partners for KRW 1.58 trillion. Lotte Shopping sold inefficient assets such as the Lotte Mart Suwon Yeongtong branch and Lotte Super Yeoui branch last year, while Hotel Lotte disposed of the L7 Gangnam by Lotte hotel for about KRW 330 billion. Last month, Lotte Corporation sold 5% of its treasury shares to Lotte Property & Development for KRW 145 billion to improve its financial structure.

While the rating downgrade will inevitably raise funding costs, the impact is expected to be limited given the current trend of lower benchmark interest rates. Lotte Corporation stated, “We have over KRW 1 trillion in immediately available cash and credit lines, so there are no liquidity concerns.”

Park seulgi (seulgi@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)