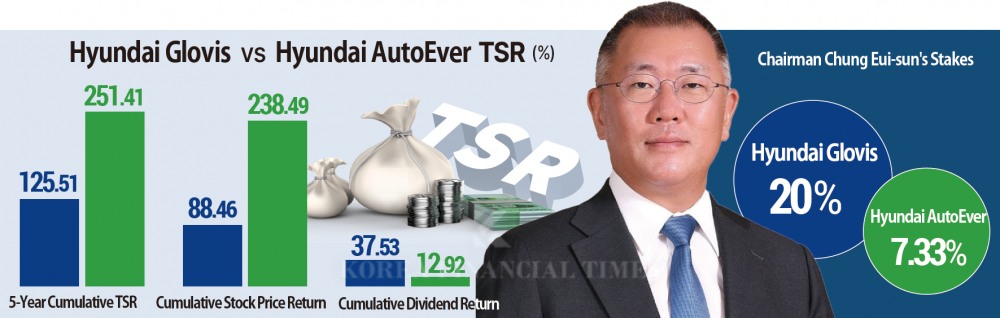

The key concern is how Chairman Chung Eui-sun will secure the necessary funds for this process. The most realistic method is to utilize his stakes in affiliated companies. This is why attention is focused on Hyundai Glovis (20.0% stake) and Hyundai AutoEver (7.3% stake), where Chairman Chung Eui-sun stands as the largest individual shareholder. Coincidentally, both companies are showing trends of expanding performance, stock prices, and dividends.

Korea Financial Newspaper calculated the cumulative Total Shareholder Return (TSR) for Hyundai Glovis and Hyundai AutoEver using the corporate data platform DeepSearch.

TSR is an indicator that adds dividend yield to stock price return over a specific period. It shows the total return shareholders can obtain by investing in company stocks. It is calculated by adding stock price fluctuation rate and dividend yield over a certain period, then dividing by market capitalization.

The calculation period spans approximately five years from 2020 to the first half of this year. During this period, Hyundai Glovis' cumulative TSR was 125.51%, while Hyundai AutoEver's was 251.41%.

This means that if someone had invested KRW 10 million each in Hyundai Glovis and Hyundai AutoEver at the beginning of 2020 and held until now, the valuation would be approximately KRW 22.55 million and KRW 35.14 million, respectively.

Hyundai Glovis is the company responsible for logistics business within Hyundai Motor Group. Since CEO Lee Kyu-bok took office in 2023, the company has been focusing on enhancing corporate value through new businesses, including actively expanding orders from external clients, moving away from the group affiliate maritime transportation-centered business structure.

The new businesses that Hyundai Glovis is currently pursuing span various fields, from aviation and special cargo transportation to LNG (Liquefied Natural Gas), used cars, and secondary battery recycling.

Hyundai AutoEver was a group SI (System Integration) subsidiary, but expanded its presence by absorbing and merging with automotive software developer Hyundai Autron and navigation developer Hyundai MnSoft in 2021. It is particularly receiving attention as a core autonomous driving subsidiary within the group, along with Forty-two Dot.

During the TSR calculation period, both companies showed stability in both stock price appreciation and dividend yield. While their dependence on affiliated companies is high, this is evaluated as consistent growth based on a stable business foundation.

Hyundai Glovis recorded a cumulative stock price appreciation of 88.46% and cumulative dividend yield of 37.05%. Stock prices rose from KRW 71,528 on the starting date to KRW 138,400, while dividends increased from KRW 1,750 per share in 2020 to KRW 3,700 last year.

Hyundai AutoEver showed a cumulative stock price appreciation of 238.49% and cumulative dividend yield of 12.92%. Stock prices rose from KRW 50,400 on the starting date to KRW 170,600, and dividends also increased from KRW 710 per share in 2020 to KRW 1,780 last year.

The high returns of both companies are positive for Chairman Chung Eui-sun's succession and circular shareholding structure resolution plan. Hyundai Motor Group's governance structure follows a circular shareholding pattern: 'Hyundai Mobis (21.9% stake in Hyundai Motor) → Hyundai Motor (34.5% stake in Kia) → Kia (17.7% stake in Hyundai Mobis) → Hyundai Mobis.' Such a structure carries the risk that if any single link faces external attack, the stability of the entire governance structure could be shaken.

For Chairman Chung Eui-sun to smoothly complete succession and unify the governance structure, a realistic option discussed is acquiring stakes held by Honorary Chairman Chung Mong-koo in Hyundai Mobis and raising them to a stable shareholding level (approximately 25%). Currently, Chairman Chung Eui-sun's stake in Hyundai Mobis is only 0.33%. The inheritance issue of Honorary Chairman Chung Mong-koo's 7.29% stake also remains.

Industry analysis suggests that Chairman Chung Eui-sun is taking a 'frontal approach' by utilizing personal assets including stakes in affiliated companies. This is why Hyundai Glovis and Hyundai AutoEver are evaluated as key elements in the succession process.

Both companies are pursuing external growth through synergy with group's new businesses such as robotics and autonomous driving, along with value-up (corporate value enhancement) programs.

Hyundai Glovis has adopted TSR as a key indicator for corporate value enhancement and presented goals including: ▲Over KRW 9 trillion investment by 2030 ▲Achieving sales of KRW 40 trillion and operating profit of KRW 2.6-3 trillion or more ▲Achieving ROE (Return on Equity) of 15% or more.

Recently, the company has been strengthening smart logistics systems incorporating AI and robotics, with synergy expected with group robot subsidiary Boston Dynamics. Hyundai Glovis currently holds a 10.94% stake in Boston Dynamics.

Jang Moon-soo, researcher at Hyundai Motor Securities, said, "Hyundai Glovis is accumulating business optimization references by utilizing Boston Dynamics products based on its know-how in building smart logistics systems," diagnosing that "considering global robotics market growth and industrial strategic direction, it will ride the wave of market growth."

Researcher Jang continued his analysis, stating, "Since Hyundai Glovis holds a 10.94% stake in Boston Dynamics as of the second quarter this year, revaluation is expected when humanoid robot company values rise."

Hyundai AutoEver is evaluated as a beneficiary of the group's future growth engine software business, including not only AI and cloud but also autonomous driving and smart factories. Recently, news has emerged that it will handle overall after-services including distribution, maintenance, and repair of robot products developed and produced by Boston Dynamics.

Oh Kang-ho, researcher at Shinhan Investment Securities, evaluated in a recent report that "Hyundai AutoEver will continue to benefit from expanded group company investments," noting that "the autonomous driving market opening, new growth engines such as robots and smart factories, and cloud growth stories are worth attention."

Kim JaeHun (rlqm93@fntimes.com)

![기관 '알테오젠'·외인 '삼천당제약'·개인 '에코프로비엠' 1위 [주간 코스닥 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021323061707087179ad43907118235313.jpg&nmt=18)

![기관 'SK하이닉스'·외인 '삼성전자'·개인 '한화에어로스페이스' 1위 [주간 코스피 순매수- 2026년 2월9일~2월13일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021322573704878179ad43907118235313.jpg&nmt=18)

![12개월 최고 연 3.25%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213084839016295e6e69892f222110224112.jpg&nmt=18)

![24개월 최고 연 3.10%…부산은행 '더 특판 정기예금' [이주의 은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085033090215e6e69892f222110224112.jpg&nmt=18)

![12개월 최고 연 4.95%, 제주은행 'MZ 플랜적금' [이주의 은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260213085723019015e6e69892f222110224112.jpg&nmt=18)

![천상영 신한라이프 대표, 수익성 저하 불구 지주 기여도 1위…올해 손해율 관리·이익효율성 제고 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260103180551057718a55064dd122012615783.jpg&nmt=18)

![24개월 최고 연 3.25%…흥국저축은행 '정기예금(강남)'[이주의 저축은행 예금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021318581601639957e88cdd521123418838.jpg&nmt=18)

![[DQN] 이환주號 국민은행, 위험밀도 1위·RoRWA 3등···진정한 '리딩뱅크' 되려면 [금융사 2025 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021604305006368b4a7c6999c121131189150.jpg&nmt=18)

![[주간 보험 이슈] 안철경 보험연구원장 후임에 이재명 씽크태크 경력 김헌수 전 순천향대 교수 外](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260210220510030248a55064dd12101238196.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)