KT's scale is growing. Revenue has grown steadily over the past five years. Revenue last year increased approximately 8.6% compared to 2020. This is due to simultaneous growth in core telecommunications business (5G, Giga Internet) as well as new businesses such as media, AI/cloud, and B2B specialized services.

KT has been accelerating expansion of AI-based services since launching the AI device 'GiGA Genie' in 2017. After 2022, as AI cloud-based platforms and AI/digital transformation (DX) infrastructure were fully commercialized, the company entered the AI/cloud business expansion stage.

According to KT's 2025 corporate value enhancement plan, cumulative AI/IT revenue for Q3 this year was KRW 900 billion, approximately 7% of service revenue on a separate basis. Considering that AI/IT revenue was ▲KRW 1 trillion (6%) in 2023 ▲KRW 1.1 trillion (7%) in 2024, collaboration with global big tech companies like Microsoft (MS) and Palantir has not produced results to meet market expectations.

KT has maintained a strategic partnership with MS since last year and agreed to jointly invest a total of KRW 2.4 trillion in AI, cloud, and IT sectors over the next five years.

In March this year, it also began cooperation with Palantir, aggressively entering the AI transformation (AX) market.

However, whether such global collaboration will continue has become uncertain. This is because CEO Kim Young-seop, who led these efforts, gave up reappointment due to the adverse effect of 'unauthorized micropayment' issues. CEO Kim is scheduled to end his term in March next year.

There are also criticisms that the collaboration results with MS did not meet expectations from the start. The two companies announced development of a Korean language-specialized AI model (SOTA K), establishment of Korean-style cloud services, and establishment of an AX specialized company, but the disclosed results did not resonate much in the market.

Particularly, the plan to establish a separate AX specialized corporation was not realized, and instead, 'KT Innovation Hub' opened in a scaled-down form last month in the West Building of KT's Gwanghwamun headquarters.

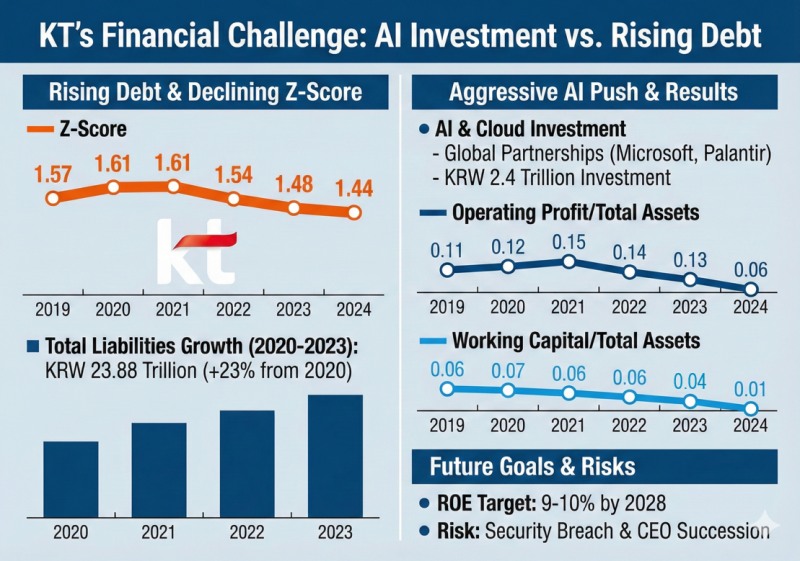

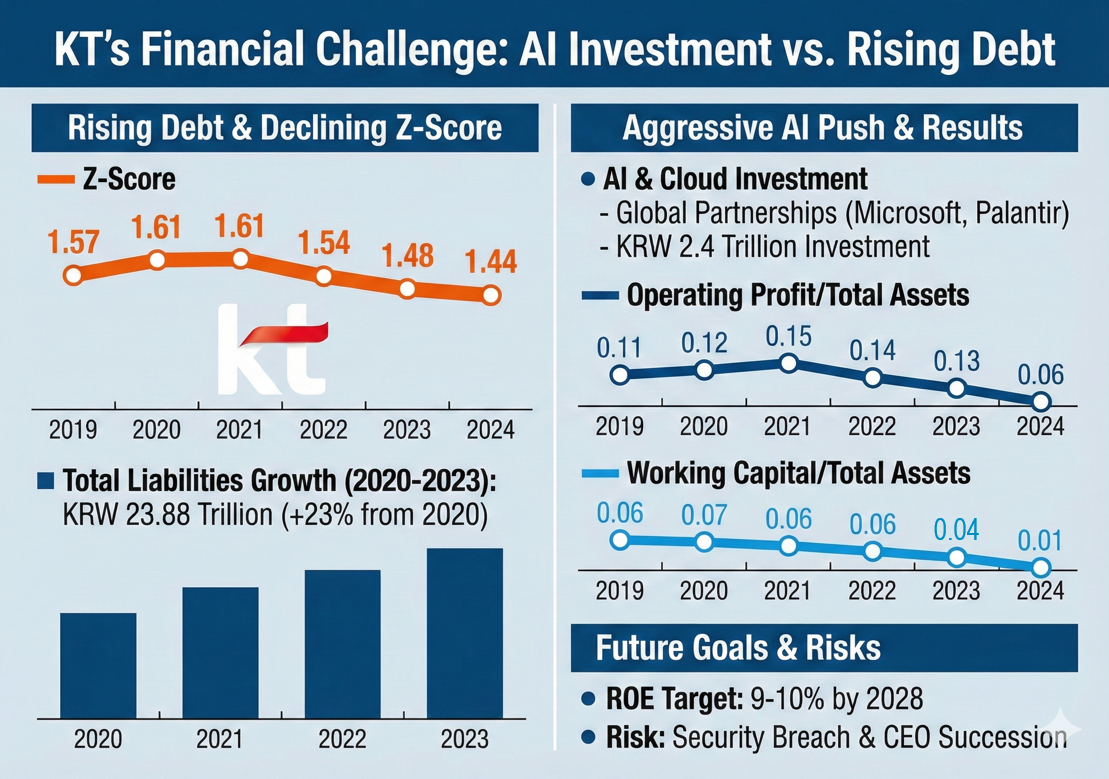

Despite large-scale investment, as global cooperation effects have not appeared distinctly, KT's financial burden is growing. Last year, KT's total liabilities were KRW 23.8834 trillion, an increase of approximately 23% compared to 2020.

KT's Altman Z-score, a representative potential insolvency measurement indicator analyzed by Korea Financial News, continuously declined to ▲1.61 in 2020 ▲1.61 in 2021 ▲1.54 in 2022 ▲1.48 in 2023 ▲1.44 in 2024.

While data center infrastructure investment and AI/cloud revenue increased, profitability relative to assets and liquidity deteriorated due to relatively slower growth of application service revenue (IT/AI services, etc.).

Looking at detailed items, 'working capital to total assets' fell from 0.07 in 2020 to 0.01 last year, significantly weakening liquidity indicators. 'Operating profit/total assets' also halved from 0.12 in 2020 to 0.06 last year, confirming the profitability deterioration trend.

From 2021-2023, KT promoted transition to an AICT (Artificial Intelligence + Information and Communications Technology) business structure, and costs increased due to large-scale investment, which led to increases in current liabilities and total liabilities. In 2023, revenue and retained earnings increased approximately 2.8% and 1.7% respectively year-over-year, but could not keep pace with debt growth. Total liabilities increased approximately 7% during the same period.

One-time costs from large-scale voluntary retirement in Q4 last year were reflected, resulting in consolidated operating profit of KRW 809.5 billion, about half the previous year's level. Retained earnings also decreased approximately 12% year-over-year to KRW 13.7798 trillion.

However, KT is maintaining growth trends in total assets and market capitalization following core business expansion.

Total assets steadily increased as investment and asset acquisition in major business groups such as AI/cloud, data centers, and real estate continued, and diversified portfolios in finance, real estate, DX, and content contributed to asset growth.

Market capitalization expanded due to combined effects including expectations for KT's AICT enterprise transformation, record-high revenue last year (KRW 26.4312 trillion), AI/IT new business growth prospects, and strategic partnership with MS.

Strengthened shareholder returns through treasury stock purchases and cancellation are also evaluated to have influenced corporate value enhancement. KT set a target of achieving Return on Equity (ROE) of 9-10% by 2028.

To this end, KT said it would pursue cumulative KRW 1 trillion in treasury stock purchases and cancellation, achieving 9% operating profit margin, expanding AI proportion in IT revenue to 19%, and liquidating non-core assets. A KT official emphasized, "We will secure future competitiveness by making AI/cloud our growth engine, expanding AI data centers, and strengthening infrastructure supply."

The problem is the recent unauthorized micropayment hacking incident. Costs including waiver of penalties for user number portability due to this will be reflected in Q4 this year. 'External pressure trauma' that may occur during the new CEO appointment process is also weighing on KT.

An industry official said, "KT's new CEO must focus on improving financial soundness through market trust recovery and strengthening mid- to long-term new businesses such as AI/cloud immediately after taking office," adding, "Not only expenditures for actual monetary damage compensation but also potential costs necessary for user trust recovery must be considered as tasks."

Jeong Chaeyun (chaeyun@fntimes.com)

![[DCM] JTBC · HL D&I 7%대...재무 취약기업 조달비용 급등 [2025 결산⑥]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013013251003407141825007d12411124362.jpg&nmt=18)

![NH투자증권, 순이익 '1조 클럽' 기록…윤병운 대표 "전 사업부문 경쟁력 강화" [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025021021370308671179ad439072211389183.jpg&nmt=18)

![다올투자증권, 연간 흑자 달성 성공…황준호 대표 실적 안정화 견인 [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025081416515608997179ad439072111812010.jpg&nmt=18)

![[DCM] 이랜드월드, KB증권 미매각 눈물…NH증권이 닦았다](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013006550302626a837df6494123820583.jpg&nmt=18)

![삼성생명 유배당 보험계약 부채 0원 두고 설왕설래…2025년 공시 촉각 [삼성생명 일탈회계 원복]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260129224736064028a55064dd118222261122.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)