Through this strategy, both companies aim to aggressively secure orders, capitalizing on the weakened influence of Chinese ESS manufacturers in the U.S. due to tariffs and regulations.

According to Samsung SDI, on the 10th, the company is participating in 'RE+ (Renewable Energy Plus) 2025', North America's largest energy industry exhibition currently held in Las Vegas, where it has unveiled its locally optimized next-generation battery product lineup.

The highlight products showcased by Samsung SDI at this event are the next-generation Solid Battery Blocks (SBBs), namely 'SBB 1.7' and 'SBB 2.0'. These products, revealed for the first time at the exhibition, are slated for local production in the U.S. starting next year.

Among these, SBB 2.0 marks Samsung SDI's debut LFP battery product. Until now, Samsung SDI had primarily focused on ternary NCA (Nickel-Cobalt-Aluminum) batteries, unlike its competitors. While NCA batteries offer higher energy density and larger capacity than LFP, their higher manufacturing cost has posed challenges in price competitiveness.

SBB 2.0 features Samsung SDI's proprietary prismatic form factor, incorporating differentiated materials and electrode plate technology. This innovation overcomes the low energy density, a common drawback of existing LFP batteries, while maximizing advantages such as safety and cost-effectiveness. Samsung SDI plans to offer customized solutions to customers by leveraging both SBB 2.0 and SBB 1.7, which is equipped with ternary NCA batteries.

While Samsung SDI unveiled its first LFP battery product, LG Energy Solution introduced prismatic batteries, a segment where Samsung SDI has traditionally excelled. This marks LG Energy Solution's first presentation of prismatic ESS batteries.

LG Energy Solution's prismatic batteries include the JF2 and JF3 battery cell and pack products. These products boast ultra-high energy density exceeding 500 Wh, while also being resistant to external impacts and offering lower production costs. LG Energy Solution's prismatic batteries are scheduled for production in North America, a first for the industry.

To achieve this, LG Energy Solution began the full-scale local mass production of LFP batteries for ESS at its Michigan plant in the second quarter of this year, an industry first in the U.S. This initiative has established a 'Made-in-USA' foundation, ensuring stable supply to local customers and enabling customers to benefit from IRA (Inflation Reduction Act) incentives for ESS installations manufactured in North America.

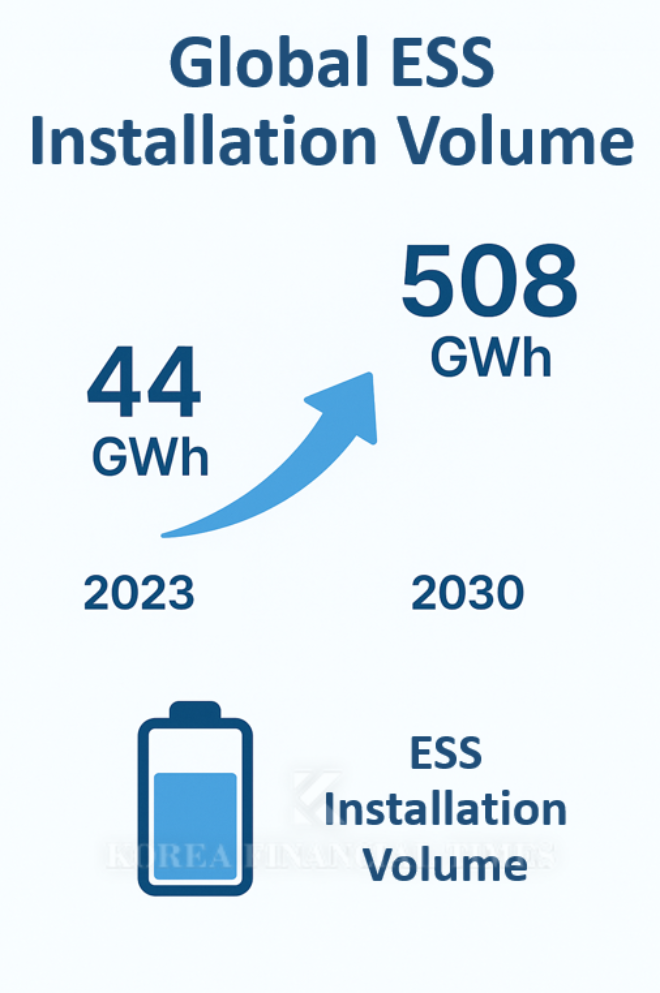

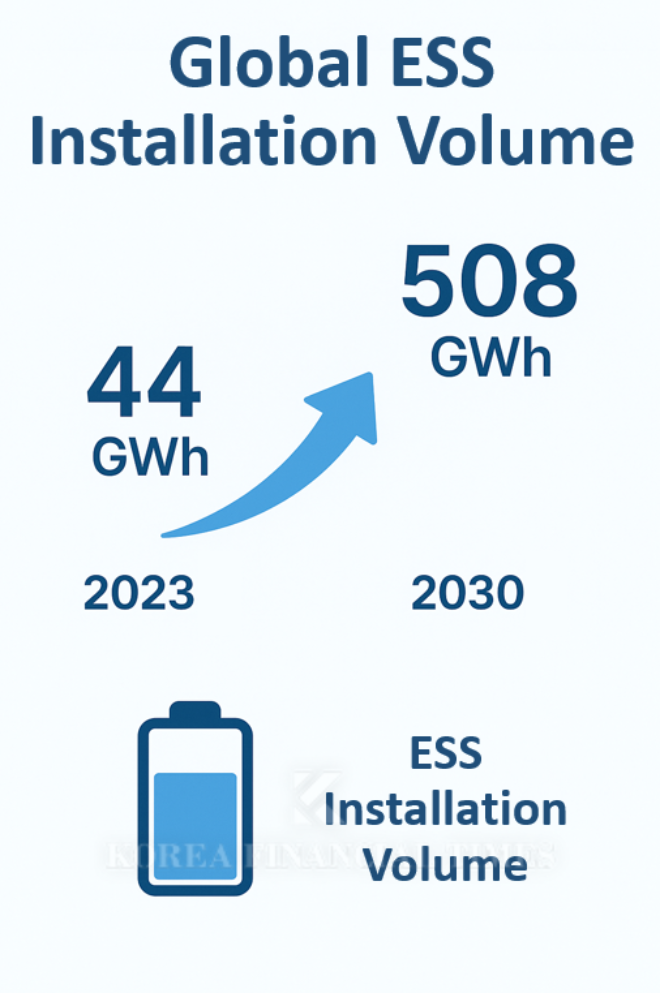

The primary reason both companies are publicly showcasing new battery products and technologies in the U.S. is the intense competition for orders. The Korea Energy Economics Institute projects that the global ESS installation capacity, which stood at only 44 gigawatt-hours (GWh) in 2023, will expand to 508 GWh by 2030. In particular, the U.S. ESS market is growing rapidly due to increasing electricity demand driven by the surging AI boom.

Furthermore, the diminished influence of Chinese ESS manufacturers in the U.S. market, due to tariff policies and regulations imposed by the Trump administration, presents an opportunity for Korean companies. Currently, the U.S. imposes a 40.9% tariff on Chinese-made ESS batteries, which is expected to increase to 58.4% next year.

Kim JaeHun (rlqm93@fntimes.com)

![‘리니지 제국'의 부진? 엔씨의 저력을 보여주마 [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020123095403419dd55077bc211821821443.jpg&nmt=18)

![[DCM] 한화시스템, FCF 적자 불구 시장조달 자신감](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020204171101504a837df6494123820583.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)