Choi Won-hyuk, CEO of HMM. /Photo provided by HMM

On June 22 (KST), Iran’s parliament approved a resolution to close the Strait of Hormuz. In response, tanker freight rates soared 30.55% week-on-week to $30,745 (about KRW 42.44 million).

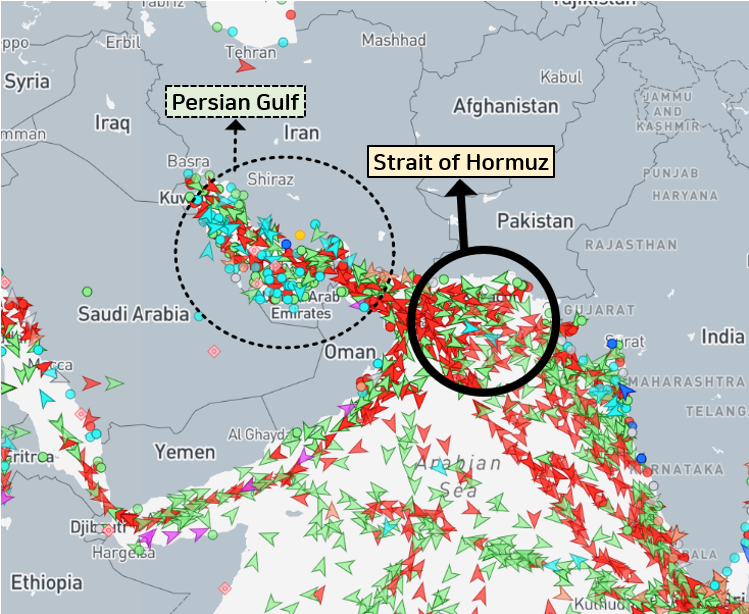

In particular, the TD3C, which is the Middle East regional index within the Baltic Dirty Tanker Index (BDTI)—the leading freight rate index for crude oil tankers—has also shown an upward trend. TD3C refers to the route from the Middle East Gulf region, including the Persian Gulf, to China, based on a 270,000-ton crude oil tanker. Major oil-producing countries in this area include Iran, Saudi Arabia, Kuwait, Iraq, and the United Arab Emirates (UAE).

In contrast, the Shanghai Containerized Freight Index (SCFI) dropped sharply, falling 10.5 percentage points week-on-week to 1,870 points as rates for North American routes declined for a second consecutive week. The Middle East is dominated by tanker traffic rather than container ships, so the SCFI is not heavily influenced by this market.

As the SCFI’s drop suggests, concerns over a Hormuz closure are not expected to have a direct impact on HMM, which mainly operates container vessels. HMM currently has only one container route passing through the Strait of Hormuz. The vessel on this route is reportedly operating on schedule. Container ships run on fixed schedules and routes.

The industry’s main concern is what happens if the Strait is actually closed. Unlike the Suez Canal, which can be bypassed by rounding the Cape of Good Hope, there is no alternative sea route for the Strait of Hormuz. If blocked, vessel movement would be impossible until the strait reopens.

However, this scenario is still somewhat removed from HMM’s core business. An industry insider noted, “It’s impossible to move 300,000 tons of crude oil by land, but for container ships, it is theoretically possible to unload standardized containers at ports and transport them by truck or rail.”

The blockade of the Strait of Hormuz has not yet become a reality. A final decision from the Supreme National Security Council (SNSC), chaired by Iranian President Masoud Pezeshkian, is required, and the approval of Supreme Leader Ali Khamenei is also necessary.

An HMM spokesperson stated, “Our container route through the Strait of Hormuz is still operating normally. If any issues arise, we are reviewing various contingency measures, including alternative ports.”

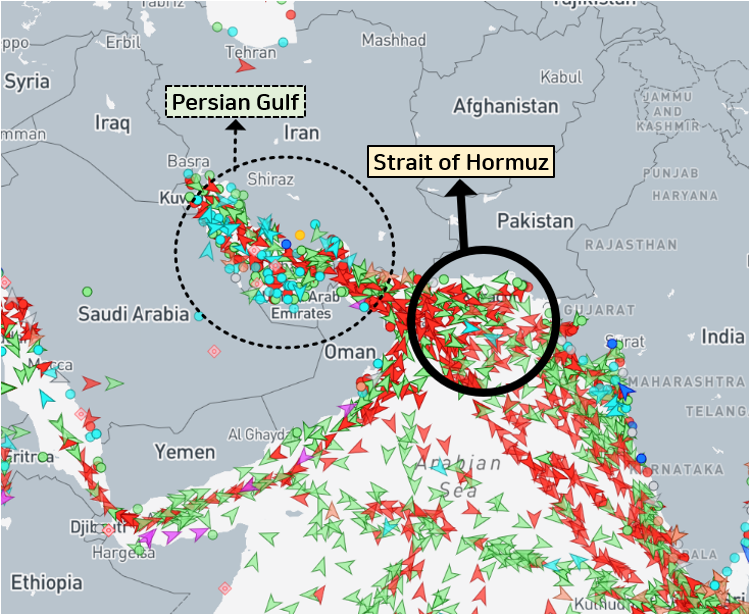

Meanwhile, HMM shares closed up 2.17% at KRW 23,500 on the day, reflecting heightened market interest in shipping stocks amid the crisis.

![기관 '한미반도체'·외인 'NAVER'·개인 '삼성전자' 1위 [주간 코스피 순매수- 2026년 1월26일~1월30일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013022473402636179ad439071182357237.jpg&nmt=18)

![[DCM] 한화시스템, FCF 적자 불구 시장조달 자신감](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020204171101504a837df6494123820583.jpg&nmt=18)

![‘리니지 제국'의 부진? 엔씨의 저력을 보여주마 [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020123095403419dd55077bc211821821443.jpg&nmt=18)

![12개월 최고 연 3.20%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 1주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260130181142061535e6e69892f18396169112.jpg&nmt=18)

![기관 '에코프로'·외인 '에코프로'·개인 '알지노믹스' 1위 [주간 코스닥 순매수- 2026년 1월26일~1월30일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013022563407542179ad439071182357237.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)