HMM logo. / Image courtesy of HMM

While shareholders may welcome the rally, the mood among employees is uneasy. There is growing concern that political interference could undermine the competitiveness of Korea’s shipping industry.

On May 21, industry sources reported that Lee Jae-myung, during a recent campaign rally in Busan, said to transform the city into a hub for the Arctic shipping route by relocating the Ministry of Oceans and Fisheries and major maritime logistics firms, including HMM, to Busan.

The controversy centers on Lee’s claim that “HMM employees also agreed to the headquarters relocation.” However, both of HMM’s main unions—the Korea Financial Industry Union HMM Branch (onshore union) and the HMM Seafarers’ Union (offshore union)—have stated, “We have never met nor agreed to this proposal”. In fact, to reassure shocked employees, the onshore union reportedly sent an email to all staff clarifying that there had been no agreement to the move.

This is not the first time the idea of moving HMM’s headquarters to Busan has surfaced. Lee Jae-myung made a similar pledge during the 2022 presidential election, aiming to turn Busan into a shipping industry hub. Ahead of last year’s April general election, he also advocated relocating the Korea Development Bank (KDB) and HMM, in which KDB is the largest shareholder, to Busan.

Although HMM is a private company, the government currently owns over 70% of its shares, with KDB holding 36.02% and the Korea Ocean Business Corporation 35.67%. Lee Jae-myung has stated, “With government investment and support, if we make up our minds, relocating to Busan is not impossible.”

This ownership structure dates back to 2016, when the government injected public funds to rescue Hyundai Merchant Marine (now HMM) after the bankruptcy of Hanjin Shipping. KDB became the largest shareholder through debt-to-equity swaps and convertible bonds.

Industry insiders argue that the government’s stake should eventually be privatized, and that KDB is not a suitable long-term owner. They also question the business rationale for relocating HMM’s headquarters, noting that shipping is a sales-driven industry and that most key clients and financial institutions are based in Seoul, not Busan. “Unlike airlines, shipping companies operate circular routes with multiple ports of call, so there is little geographic or economic advantage to having the headquarters in Busan,” said one industry official.

Another pointed out that most of the container management and shipping staff are already based in Busan, while sales and finance personnel—crucial for ship investment and client relations—are concentrated in Seoul. “Relocating the headquarters could result in significant employee attrition,” the official warned.

As of the end of last year, HMM had 1,824 employees, including regular and contract staff. Of these, 1,063 were onshore staff based in Seoul, and 827 were seafaring crew, with onshore staff accounting for just over 58%.

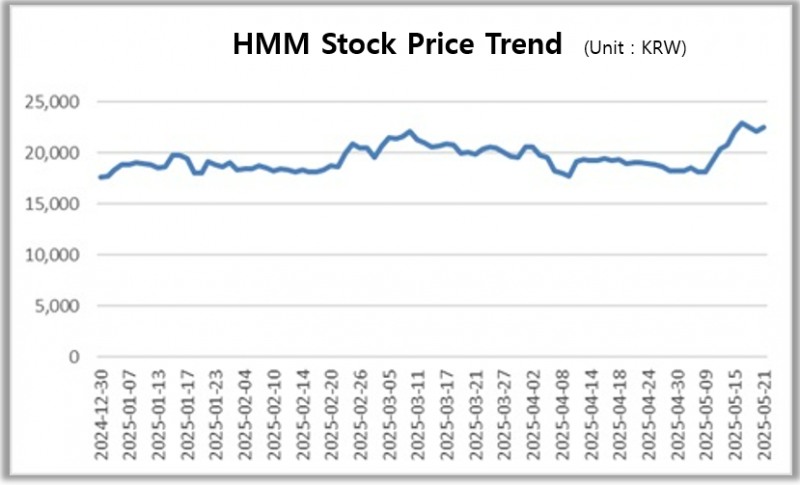

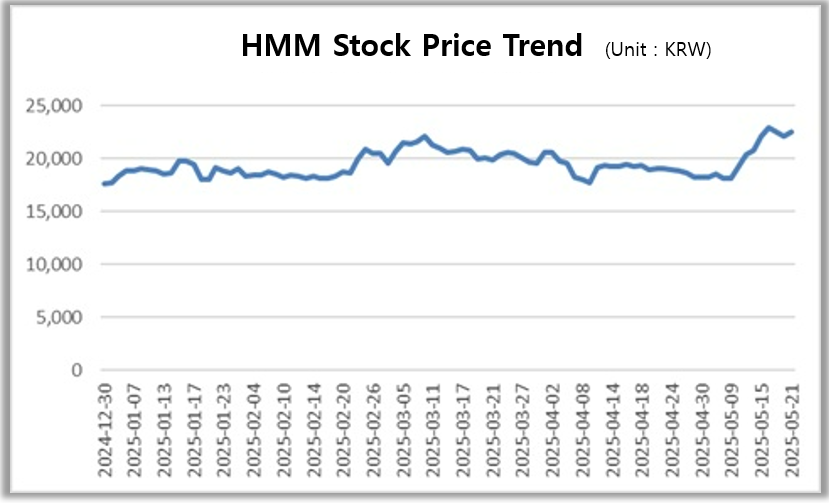

Despite the internal turmoil, HMM’s stock price surged 6.49% to KRW 22,150 on May 15, the day after Lee’s campaign rally. It marks the second-highest gain for the stock so far this year.

Regardless of the reasons, HMM’s stock has maintained its momentum, closing at a record high of KRW 22,950 on May 16, and ending at KRW 22,100 on May 20 and KRW 22,350 on May 21.

Adding to the positive sentiment, NICE Investors Service upgraded HMM’s credit rating by two notches from ‘A- (Stable)’ to ‘A+ (Stable)’ on May 19.

HMM now boasts cash and cash equivalents of KRW 3.1303 trillion as of the end of March, up 192.41% year-on-year, putting its liquidity on par with global shipping giants.

Shin Haeju (hjs0509@fntimes.com)

![기관 '한미반도체'·외인 'NAVER'·개인 '삼성전자' 1위 [주간 코스피 순매수- 2026년 1월26일~1월30일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013022473402636179ad439071182357237.jpg&nmt=18)

![[DCM] 한화시스템, FCF 적자 불구 시장조달 자신감](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020204171101504a837df6494123820583.jpg&nmt=18)

![‘리니지 제국'의 부진? 엔씨의 저력을 보여주마 [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020123095403419dd55077bc211821821443.jpg&nmt=18)

![12개월 최고 연 3.20%…SC제일은행 'e-그린세이브예금' [이주의 은행 예금금리-2월 1주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260130181142061535e6e69892f18396169112.jpg&nmt=18)

![기관 '에코프로'·외인 '에코프로'·개인 '알지노믹스' 1위 [주간 코스닥 순매수- 2026년 1월26일~1월30일]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026013022563407542179ad439071182357237.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)