KCC disclosed its 'treasury stock utilisation plan' at 8:12am on the 24th, just before the regular market opening. This represents the first corporate value enhancement plan extension since the company's launch in July, forming part of its financial strategy. At the time, the company only mentioned 'asset efficiency and capital structure optimisation' without revealing specific detailed plans.

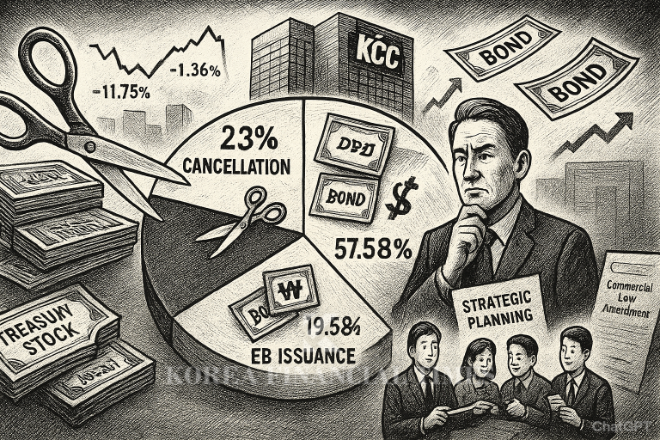

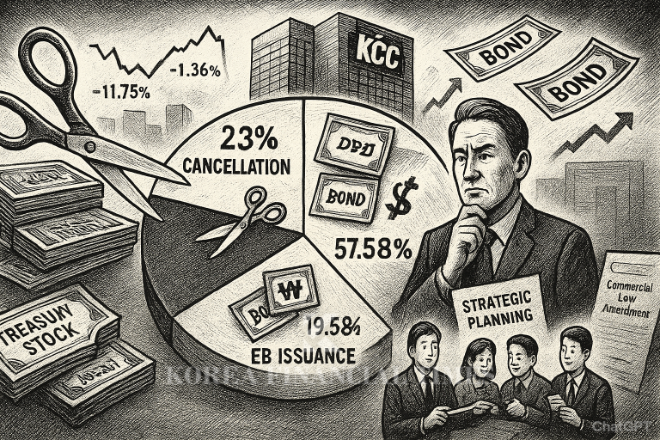

KCC holds 1,532,300 treasury shares, equivalent to 17.24 percent of total issued shares, which it plans to utilise across exchangeable bond (EB) issuance, cancellation, and contribution to the employee welfare fund. The allocation comprises 882,300 shares (57.58 percent) for EB issuance, 300,000 shares (19.58 percent) for employee welfare fund contribution, and 350,000 shares (22.84 percent) for treasury stock cancellation.

However, as the board resolution has not yet taken place, the plan will be finalised through future board meetings. EB issuance is expected in the fourth quarter of this year, while treasury stock cancellation and welfare fund contribution are anticipated between the fourth quarter of this year and the first quarter of next year.

Some observers view this decision as a measure to avoid complete treasury stock cancellation. The National Assembly is currently pursuing third commercial law amendments containing mandatory treasury stock cancellation provisions. Discussions also include allowing treasury stock retention for legitimate reasons such as employee compensation and employee stock ownership association contributions.

The employee welfare fund serves as welfare resources for employee housing loans, education funds, and medical expense support. While treasury shares purchased with company funds lack voting rights, these rights are restored when contributed to third parties such as welfare funds.

In particular, critics argue that KCC, given its substantial financial asset holdings, should have considered utilising its Samsung C&T shares (10.1 percent stake) this time. This follows a similar approach when the company issued KRW 882.8 billion worth of EBs backed by HD Korea Shipbuilding & Offshore Engineering shares in July to repay borrowings.

Jung Kyung-hee, analyst at LS Securities, noted: "Institutional investors' primary demand is liquidation of Samsung C&T shares purchased in 2012. Issuing KRW 430 billion worth of treasury stock EBs without utilising Samsung C&T shares, which offer only 1.34 percent dividend yield, represents an unusual decision from equity investors' perspective."

She evaluated this as "a move contrary to government and capital market efforts to escape the 'Korea Discount'."

Treasury stock cancellation is generally recognised as the most effective shareholder return method. Conversely, utilising shares for EB issuance makes it difficult to avoid criticism of weak shareholder return commitment. However, from a corporate perspective, issuing EBs backed by treasury shares offers the advantage of securing funds without diluting management control. Unlike rights offerings, no new shares are issued, maintaining existing shareholders' ownership ratios.

Currently, Chairman Chung Mong-jin is KCC's largest shareholder with a 20 percent stake. Including specially related parties, this reaches 35.61 percent. Adding treasury shares brings the ownership ratio above 50 percent, securing stable management control.

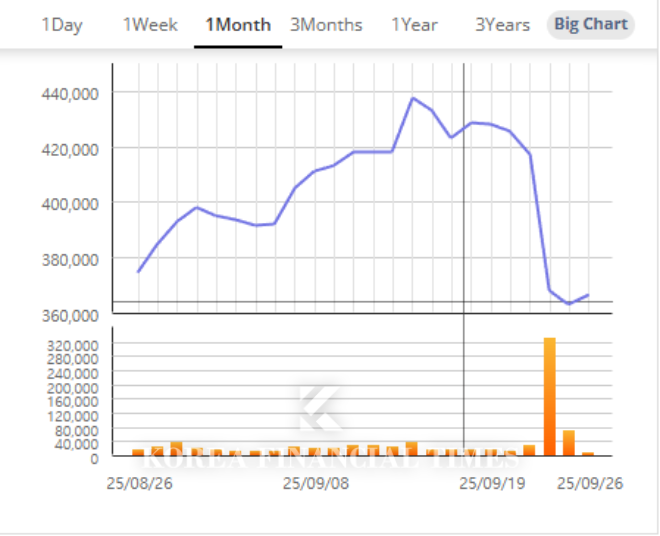

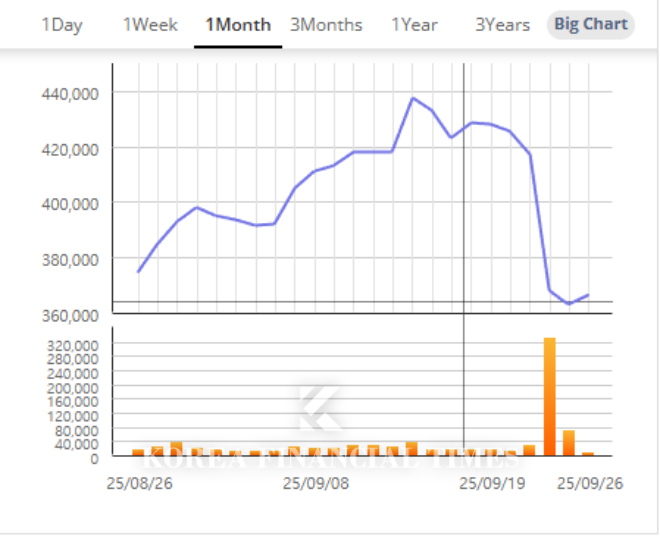

Following the treasury stock utilisation plan announcement, KCC shares closed at KRW 368,000 on the 24th, down 11.75 percent from the previous day. The closing price on the 25th recorded KRW 363,000, down 1.36 percent from the previous day.

Shin Haeju (hjs0509@fntimes.com)

![[DCM] ‘미매각 악몽’ 이랜드월드, 재무 부담 가중…고금리 전략 ‘의문부호’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012909073902617a837df64942115218260.jpg&nmt=18)

![하나금융·한국투자, 예별손보 인수전 참전 속내는 예보 지원…완주 여부는 물음표 [보험사 M&A 지형도]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260127165113038799efc5ce4ae211217229113.jpg&nmt=18)

!['모범생' 기업은행, 이슈메이커 '올데프' 모델 발탁 이유는 [은행은 지금]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260126171801028565e6e69892f18396169112.jpg&nmt=18)

![부동산 중도금 대출자 채무 무효 줄소송…캐피탈·저축은행 건전성 '경고등'·소비자도 '피해' [2026 금융권 리스크 뇌관]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2022092610145905229058367437222210913866.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)