KCC (CEOs Chung Mong-jin, Chung Jae-hoon), a major precision chemical company producing paints, silicones, and advanced materials, unveiled a plan to enhance corporate value on July 3. This marks the first time in 52 years since its KOSPI listing in 1973 that KCC has announced such a value-up plan.

The Core Issue: Financial Assets and Interest Costs

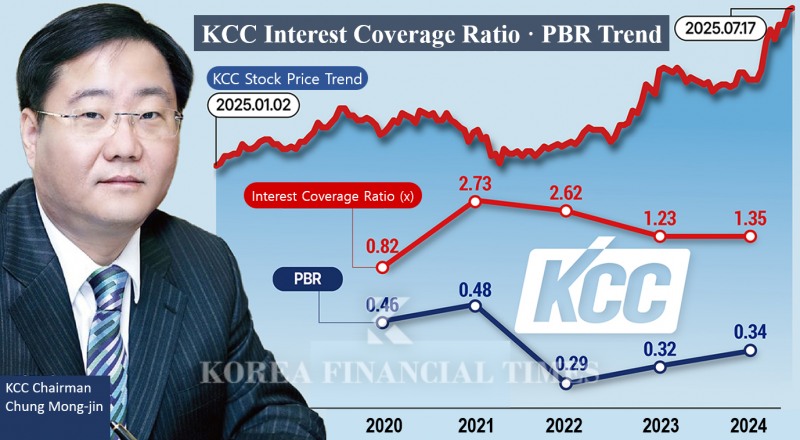

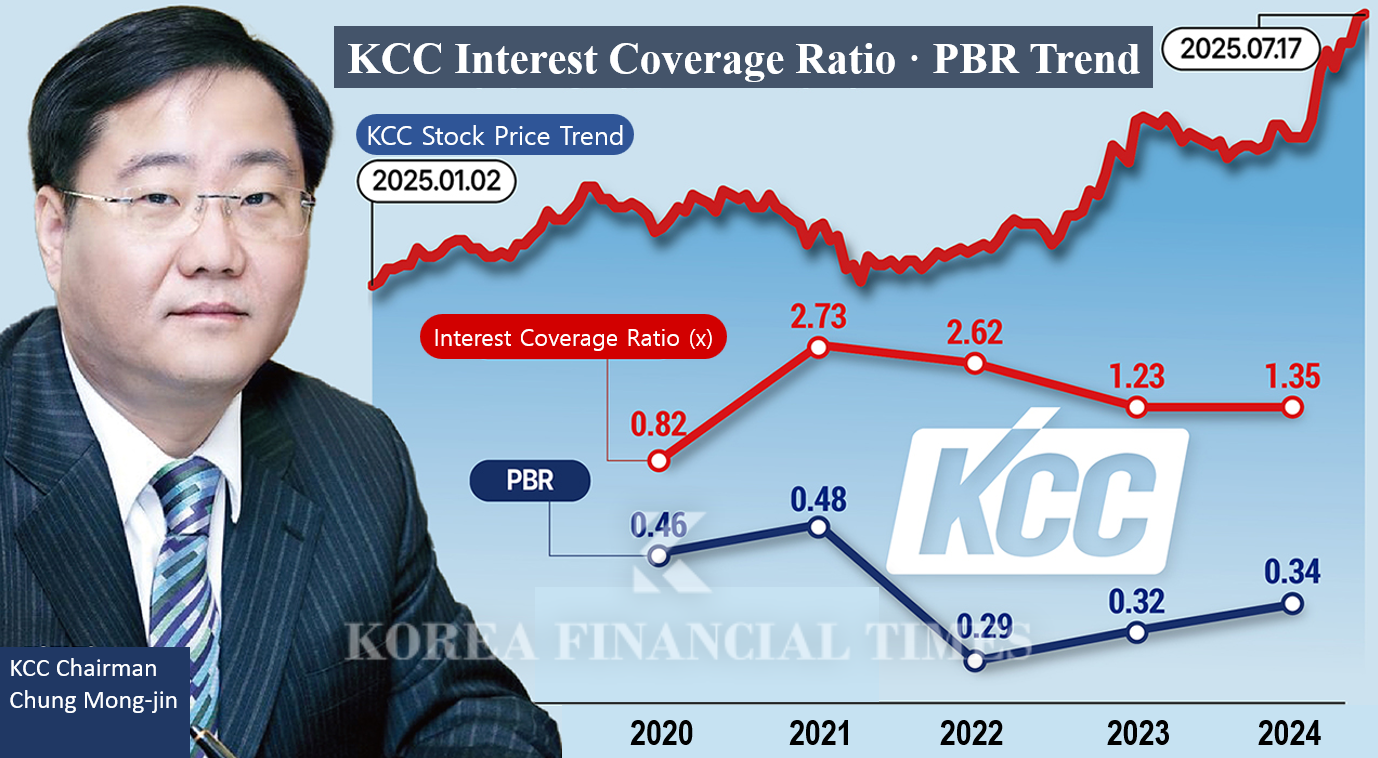

KCC aims to achieve a price-to-book ratio (PBR) above 1.0, interest coverage ratio above 2.0, sales of KRW 10 trillion, and an operating profit margin of 10% by 2030.At the end of last year, KCC’s PBR was only 0.34. After falling from 0.48 in 2021 to 0.29 in 2022, it edged up to 0.32 in 2023. PBR, calculated as share price divided by book value per share (BPS), indicates how much the market values a company relative to its net assets. A PBR above 1 suggests the stock commands a premium or is overvalued, while a figure below 1 signals undervaluation.

KCC’s unusually low PBR is due to its unique financial structure, which includes a large proportion of financial assets. Looking at the financial figures alone, KCC appears to be as much an asset manager as a manufacturer of building materials, paints, and silicones. Currently, KCC holds stakes in 36 companies, including a 10.01% share in Samsung C&T and a 3.91% stake in Korea Shipbuilding & Offshore Engineering.

At the end of 2023, KCC’s consolidated total assets stood at KRW 13.1086 trillion. Of this, financial assets accounted for KRW 5.1546 trillion (39.32% of total assets), while tangible assets—core to its main business—amounted to KRW 3.5255 trillion (26.89%).

KCC posted a net profit of KRW 293.3 billion last year, but the valuation gains on its financial assets alone reached KRW 342.2 billion. Although operating profit (KRW 471.1 billion) exceeded these valuation gains, it is clear that a significant portion of KCC’s profit comes from investments in stocks and other financial assets, not just its main business.

A securities industry official noted, “When the share prices of companies in KCC’s investment portfolio rise, so do its financial income and net profit. Since late March, Samsung C&T’s share price has surged over 50%, and Korea Shipbuilding & Offshore Engineering’ has risen about 60%.”

However, KCC’s growing headache is its ballooning interest expenses. After acquiring U.S. silicone manufacturer Momentive Performance Materials (Momentive) in 2019 through special purpose company MOM Holding Company, KCC has been burdened by heavy interest costs linked to increased net debt.

Total borrowings, previously stable at around KRW 2 trillion, now exceed KRW 5 trillion. At the end of 2023, KCC’s consolidated borrowings stood at KRW 5.3 trillion, rising to KRW 5.6 trillion in the first quarter of this year.

The interest coverage ratio, which indicates debt-servicing capacity, is now at a somewhat precarious level. A ratio below 1.5x signals repayment risk. Last year, KCC’s interest coverage ratio was 1.35x—a sharp decline from 10x in 2015.

To address this, KCC is actively working to improve its financial structure. This year, it completed a revaluation of its major land and investment properties. Land revaluation gains totaled KRW 1.2 trillion, while gains on investment properties reached KRW 300 billion—boosting equity by over KRW 1 trillion. As a result, the debt ratio dropped from 160% at the end of last year to 141% in the first quarter of this year.

Lee Dong-wook, an analyst at IBK Investment & Securities, explained, “KCC repaid about USD 400 million in debt last year, completing 25% of its acquisition financing repayments and reducing annual interest expenses by KRW 40–50 billion.”

Recently, KCC issued KRW 882.8 billion in exchangeable bonds (EB) based on its Korea Shipbuilding & Offshore Engineering shares and added KRW 100 billion in loans, investing a total of about KRW 1 trillion in MOM Holding Company. These funds will be used to repay KRW 643.8 billion in debt borrowed from a KB Kookmin Bank consortium and other acquisition-related loans.

Park Se-ra, an analyst at Shinyoung Securities, said, “This EB issuance is expected to reduce annual interest costs by about KRW 60 billion and improve the interest coverage ratio to 1.56x.”

Treasury Stock Retirement? Or Sale of Stakes?

Market attention is now focused on how KCC will handle its treasury shares, which account for over 17% of total shares outstanding.With the likelihood of mandatory treasury stock cancellation increasing, KCC could consider maximizing shareholder value by utilizing its treasury shares. Market sources say, “If KCC cancels all its treasury shares, BPS would rise 14%, increasing shareholder value accordingly.”

However, it is unclear whether KCC will go this far. Chairman Chung Mong-jin is the largest shareholder with a 20% stake, and together with special related parties, he controls 35.61% of the company. Retaining treasury shares would further stabilize management control, so there appears to be little incentive to risk management stability by canceling them.

Indeed, KCC’s value-up plan makes no mention of treasury share cancellation. The recent EB was also based on HD Korea Shipbuilding & Offshore Engineering shares, not treasury shares.

Liquidation of financial assets is also being discussed as a way to address low PBR. According to LS Securities, selling the Samsung C&T stake to repay debt could reduce annual interest costs by about KRW 123.3 billion. Selling the HD Korea Shipbuilding & Offshore Engineering stake would generate approximately KRW 820 billion in cash, and using it to repay debt would save KRW 50.9 billion in annual interest. This would reduce interest expenses, improve net profit and ROE, and help KCC escape the low-PBR trap.

Shin Haeju (hjs0509@fntimes.com)

![[DCM] ‘미매각 악몽’ 이랜드월드, 재무 부담 가중…고금리 전략 ‘의문부호’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012909073902617a837df64942115218260.jpg&nmt=18)

![[DCM] 심상치 않은 증권채…속내는 ’진짜’ IB 출현 기대](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012818485407194a837df6494123820583.jpg&nmt=18)

!['운명의 날' 함영주 하나금융 회장, 사법리스크 벗을까 [금융사 CEO 이슈]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026012823385403246b4a7c6999c121131189150.jpg&nmt=18)

![[카드뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)