YONG Seok-woo, President of Samsung Electronics' Visual Display (VD) Business Unit / Photo credit: Samsung Electronics

이미지 확대보기According to industry sources, Samsung Electronics' Visual Display (VD) Business Unit recently initiated a comprehensive management diagnosis spearheaded by Samsung Global Research. This marks the first group-wide management review for the VD unit in a decade, with the last one conducted in 2015. Notably, the VD Business Unit had already entered an emergency management phase in May this year, focusing on workforce optimization.

Similarly, LG Electronics began accepting applications for voluntary retirement last month within its Mobile Solutions (MS) Business Division, which handles aspects of its TV operations, marking the first such initiative in two years.

The primary reason behind these organizational restructurings is the eroding market position of both companies in the global market, largely attributable to the "cost-effectiveness offensive" launched by Chinese competitors.

Data from market research firm Omdia and the respective companies reveals that, as of Q1 this year, Samsung Electronics held a 30% share in global TV revenue, with LG Electronics at 16.2%, securing the first and second positions. However, when considering shipment volume, Samsung's share stands at 19.2%, and LG's at 10.7%. Chinese players TCL (13.7%) and Hisense (11.9%) have overtaken LG Electronics and are now aggressively closing in on Samsung Electronics.

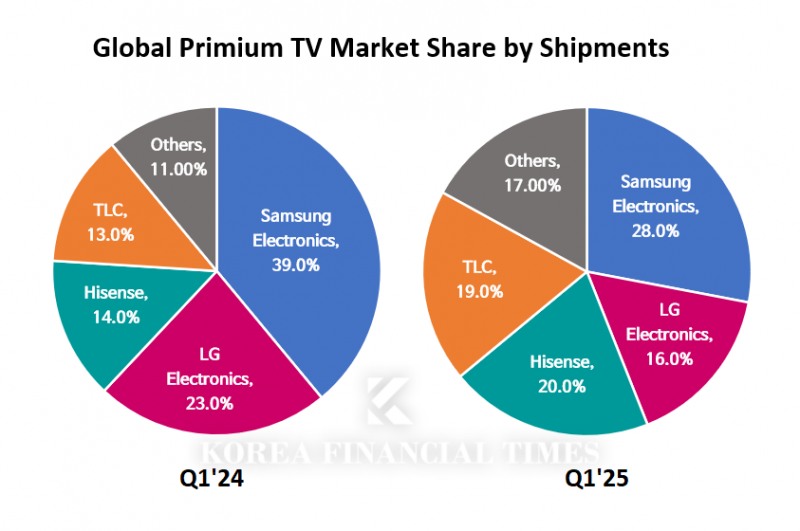

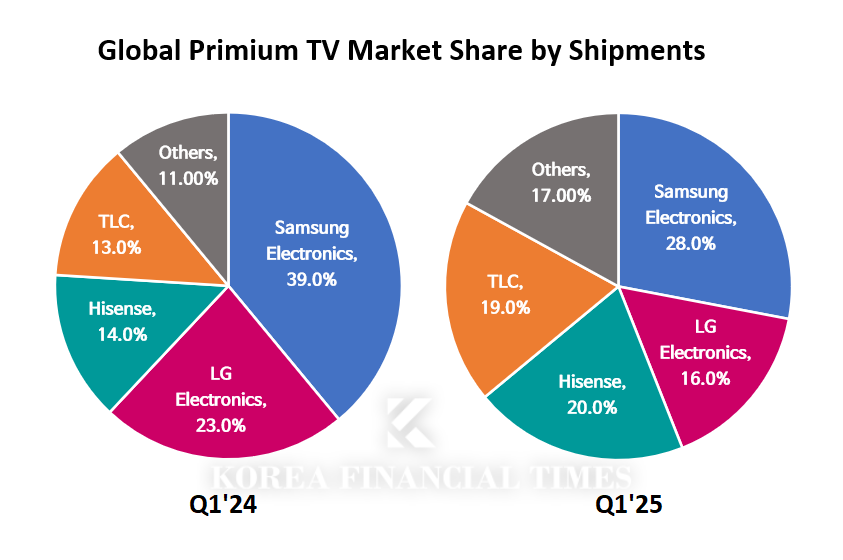

Chinese manufacturers are rapidly enhancing their quality competitiveness in addition to offering lower prices, thereby escalating the competitive threat. This has placed increasing pressure on Samsung Electronics and LG Electronics to lower their prices. The growth of Chinese companies is particularly noticeable in the premium segment, specifically for large-screen TVs exceeding 75 inches. According to Counterpoint Research, Q1 shipment share for this segment saw Samsung Electronics at 39%, followed by Hisense at 20%, TCL at 19%, and LG Electronics at 16%. Compared to a year prior, Samsung's share declined by 11 percentage points, while both TCL and Hisense expanded their shares by 6 percentage points each.

Given these circumstances, the TV business performance has also been sluggish. Samsung Electronics' VD Business Unit reported Q2 revenue of 7 trillion Korean won (KRW), a 7% decrease year-on-year. The combined operating profit for the VD and Digital Appliances (DA) Business Units stood at 200 billion KRW, representing a 60% reduction. During the same period, LG Electronics' MS Business Division recorded a 13.5% decline in revenue to 4.4 trillion KRW and registered an operating loss of 191.7 billion KRW.

A palpable sense of crisis is emerging at Samsung Electronics, where its long-held position as the global No. 1 TV manufacturer for 19 consecutive years until last year is now perceived as being under threat. Yong Seok-woo, Head of Samsung Electronics' VD Business Unit, acknowledged this reality at a new product launch event in April, stating, "The entry of Chinese companies into the mid-segment market is a reality," and added, "Samsung is also expanding its product lineup."

Gwak Horyung (horr@fntimes.com)

![[금융가Talk] SBI저축은행, '올해의 SBI인' 대상에 최초 개인직원이 받은 배경은](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024032422091902574dd55077bc22109410526.jpg&nmt=18)

![[DCM] HD현대오일뱅크, 정제마진 개선 의미와 신용도 재평가](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020306545306387a837df6494123820583.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)