CEO Cho Joo-wan, LG Electronics

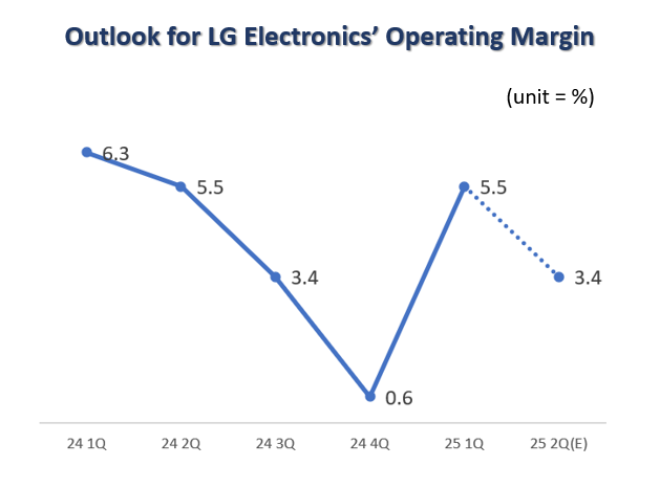

According to financial data provider FnGuide, as of the 23rd, the consensus for LG Electronics’ Q2 results is sales of KRW 21.6688 trillion and operating profit of KRW 927.1 billion (operating margin 4.3%).

Recently released analyst reports are even more pessimistic.

On the 19th, Daishin Securities analyst Park Kang-ho lowered his estimate for LG Electronics’ operating profit from KRW 952 billion to KRW 870 billion, a roughly 9% cut. The sales estimate is similar to consensus. This would result in an operating margin around 4.0%.

Park noted, “Global TV sales are underperforming expectations, and rising global prices and increased tariff impacts are weighing on the home appliance division. While LG Electronics preemptively built up inventory in Q1 to prepare for tariffs, that effect will diminish from Q2 onward.”

In a report released on the 23rd, Mirae Asset Securities analyst Park Joon-seo projected operating profit at KRW 735 billion, more than 20% below consensus, suggesting a possible earnings shock. The operating margin is forecast at 3.5%, about half the level of a year ago.

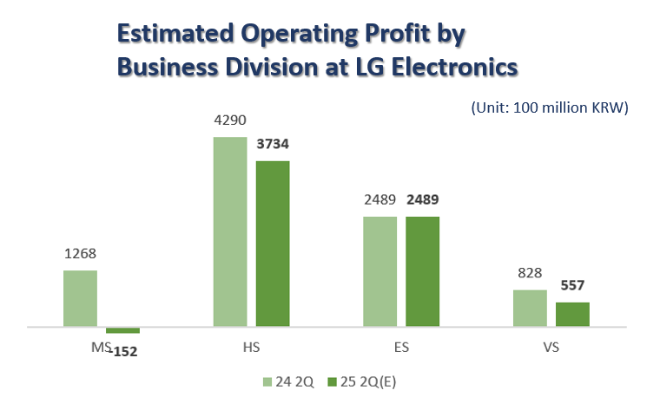

The MS Division, which handles TVs and monitors, is expected to swing to an operating loss of KRW 15.2 billion. This division recorded operating profit of KRW 127 billion in Q2 last year, but has posted sub-1% margins for three consecutive quarters since then.

The HS (Home Appliance & Air Solution) Division, which has supported earnings so far, is also expected to see operating profit fall 13% year-on-year to KRW 373.4 billion.

LG Electronics is expanding its washing machine plant in Tennessee to respond to tariffs, but there are limits to how quickly export volumes can be shifted.

The ES Division, newly established at the end of last year to expand the HVAC (Heating, Ventilation, and Air Conditioning) business, is expected to post operating profit of KRW 248.9 billion, similar to a year earlier. However, as a B2B-focused business, profit is expected to fall sharply from Q1 (KRW 406.7 billion), when infrastructure project spending peaked.

This is because logistics costs, which have been the main drag on earnings since last year, are now clearly trending downward. According to the Korea Customs Logistics Association, the Shanghai Containerized Freight Index (SCFI) stayed between 1,200 and 1,900 points through May this year. Although it rose to 2,200 points this month due to the Israel-Iran conflict, it is still well below the 3,700-point level of late last year.

The effects of these reduced logistics costs are expected to be reflected in the company’s performance starting from the third quarter, with a time lag.

Gwak Horyung (horr@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)