POSCO Future M, Chief Financial Officer (CFO) Jeong Dae-hyung / photo = POSCO Future M

However, Chief Financial Officer (CFO) Jeong Dae-hyung continues to face challenges. The company is grappling with persistent financial instability due to repeated profit declines and weak cash inflows relative to heavy investments. Jeong has recently begun adjusting the pace of battery-related investments, signaling a shift to a more defensive financial posture.

Known within the POSCO Group as a “focus and concentrate” strategist, Jeong is not a traditional POSCO executive. Born in 1968 and a graduate of Yonsei University’s Business Administration program, Jeong previously worked at leading consulting firms including PwC, Deloitte, and A.T. Kearney Korea, before joining Samsung’s restructuring office. He entered the POSCO Group in 2015 through the then-Value Management Office (now the Strategy & Planning Division).

Since joining POSCO, Jeong rose to Senior Vice President in 2019 and held various leadership roles in strategy and restructuring, including Head of the Corporate Strategy Office. After the launch of POSCO Holdings in 2022, he was promoted to Executive Vice President and took charge of strategic planning before becoming head of the Strategy Division the following year. He joined POSCO Future M in 2024, where he currently serves as CFO.

At the time of his appointment, POSCO Future M was already dealing with worsening performance and rising financial risks driven by the EV chasm. Given that the company serves as the core battery affiliate in the group’s future growth plan, Jeong’s capabilities in corporate strategy and financial management quickly became a focus of attention.

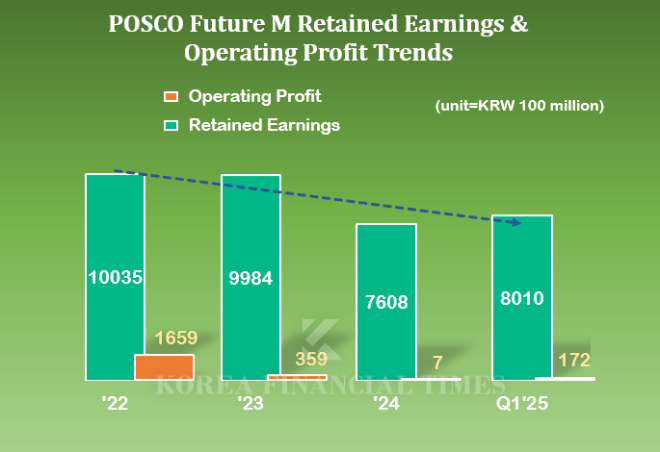

POSCO Future M’s annual operating profit peaked at KRW 165.9 billion in 2022, buoyed by growth in the EV market. However, the figure has declined for three consecutive years. Particularly in 2023, the effects of the EV chasm dragged operating profit down to just KRW 700 million.

In Q1 2024, the company posted a turnaround in operating profit with KRW 17.2 billion. However, this was largely driven by a one-off gain of KRW 52.1 billion from the sale of its cathode material plant in Gumi on February 24. According to financial data provider FnGuide, POSCO Future M’s estimated Q2 operating profit is expected to fall back to KRW 10.7 billion.

Despite deteriorating profitability, the company has continued to invest in its battery materials business to strengthen competitiveness. Major projects include the NCA cathode material plant in Gwangyang and a joint venture cathode plant in Canada with GM, aimed at bolstering its global battery supply chain.

As a result, the company’s cash reserves have rapidly declined. POSCO Future M’s cash flow from investing activities worsened from negative KRW 54.6 billion in 2022 to negative KRW 1.0314 trillion in 2023, and further to negative KRW 1.8103 trillion last year. A larger negative figure indicates greater cash outflows due to investment. While income is shrinking, rising expenditures have also eaten into retained earnings, which fell from KRW 1.0035 trillion in 2022 to KRW 998.4 billion in 2023 and KRW 760.8 billion in 2024.

Meanwhile, the company’s total borrowings, which had hovered around KRW 1 trillion, exceeded KRW 3 trillion for the first time in Q1 2024. Although retained earnings grew by about KRW 40 billion to KRW 801 billion in the same period, the amount remains insufficient to offset debt pressure.

In May, CFO Jeong responded with a capital raise of KRW 1.1 trillion to support investments and stabilize the company’s finances. According to POSCO Future M’s public filings, the company will issue 11.48 million new shares at KRW 95,800 each. Parent company POSCO Holdings will inject KRW 525.6 billion to fully acquire its 59.7% allotted share of the new stock.

Joo Min-woo, an analyst at NH Investment & Securities, stated, “Due to the likely expiration of U.S. EV tax credits, we are lowering POSCO Future M’s earnings forecast based on expectations of weaker U.S. EV sales in 2026. It will also take time to stabilize the production yield of precursor materials, which limits the company’s earnings momentum in the second half.”

CFO Jeong is also taking a more conservative stance on capital expenditures. According to POSCO Future M, the company has postponed the capital contribution dates for its joint ventures in Zhejiang, China—Zhejiang Huapoxin Energy Material Co., Ltd. and Zhejiang Pohua Xin Energy Material Co., Ltd.—from June to December.

These joint ventures were established to respond to growing local demand for precursor and cathode materials. POSCO Future M had originally planned to invest KRW 176.9 billion (50.43% stake) in Pohwa for cathode production and KRW 104.1 billion (32.49% stake) in Huapo for precursor production. However, due to the prolonged EV chasm, the capital schedule was reportedly adjusted.

The company also revised its plant construction schedule in Pohang. POSCO Future M had planned to invest KRW 461.2 billion in a new anode production facility capable of manufacturing 13,000 tons of synthetic graphite annually. While the plant was initially set for completion by June 30, the schedule has now been delayed based on internal and market conditions. A new timeline has not yet been confirmed.

Kim JaeHun (rlqm93@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)