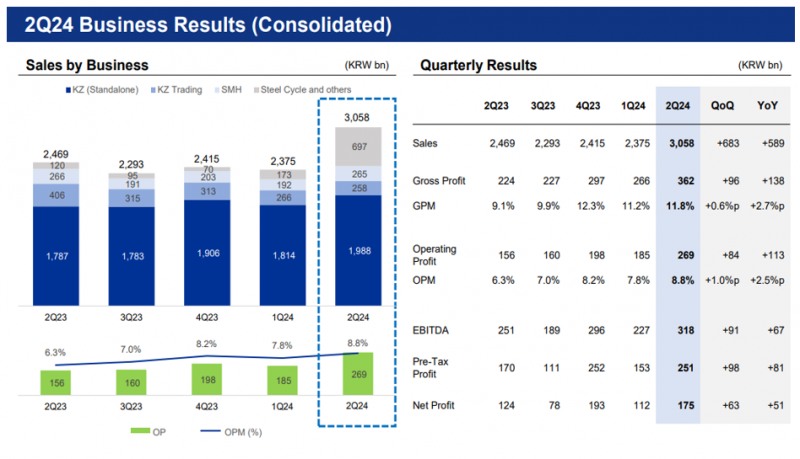

The company's sales and operating profit forecast for the 3rd quarter, as compiled by FnGuide on Sept. 9, is KRW 3.192 trillion and KRW 265 billion. The company is expected to post sales of KRW 3.225 trillion and operating profit of KRW 265 billion in the 4th quarter. The consolidated operating profit forecast for the second half of the year is 17% higher than the first half of the year and 48% higher than the first half of last year.

Korea Zinc is engaged in the business of producing and selling non-ferrous metals such as zinc and lead. The company also recovers and sells gold, silver, and copper from the smelting process, and when the prices of these products increase, the company's performance also increases.

Although the prices of non-ferrous metals have been falling recently due to recessionary concerns, the outlook for the company's performance in the second half of the year is positive as gold and silver prices are expected to strengthen in addition to expectations of interest rate cuts in the US.

“Given the economic slowdown concerns, interest rate cut expectations, and unstable international situation, the company will continue to benefit from stronger precious metal prices in the 2nd half of the year,” said Lee Jae-gwang, a researcher at NH Investment & Securities, in a report on Korea Zinc.

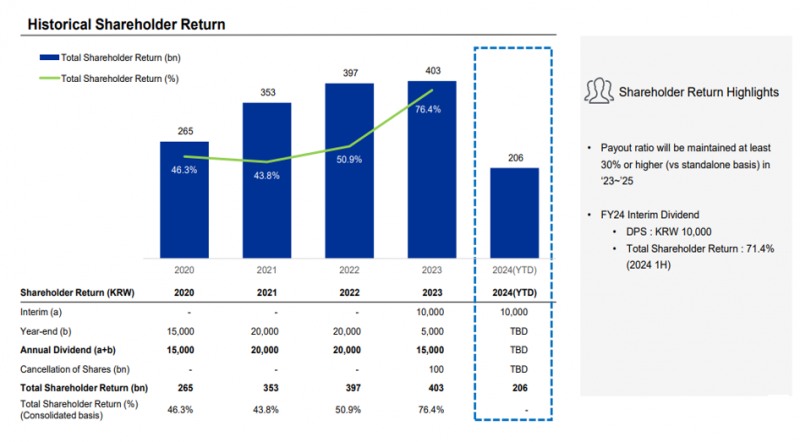

As the company's performance has been on the upswing, it has also been materializing its shareholder return plan.

At the same time, the company said it has approved a plan to buy back 400 billion won of its own shares. The reason for the purchase is to enhance shareholder value, including incineration, and the scale of incineration will be disclosed again when it is implemented until May next year.

Previously, the company had decided to buy back KRW 150 billion of its own shares in May. In November last year, it also announced a plan to buy back KRW 100 billion of its own shares, which it burned in May this year.

The reason why the company favors share buybacks over dividends as a way to return to shareholders is related to the company's shareholding structure.

Korea Zinc is a family of the Youngpung Group, which was co-founded in 1949 by founders Jang Byung-hee and Choi Ki-ho. Recently, Choi Yoon-beom, the 3rd generation of Korea Zinc, has moved to separate the affiliates and is at odds with the Jang family.

The largest shareholder of Korea Zinc is Youngpung, which holds 25.4%. Including this, the Jang family owns 32% of the company. The larger the dividend, the greater the benefit to the Jang family.

While the personal shareholding of the current executive chairman, Choi Yoon-beom, is low at 1.84%, the favorable shareholding of related parties is estimated to be over 33%. In particular, Choi's camp has used domestic companies such as LG, Hanwha, and Hyundai Motor Group as allies to raise their shareholdings. In the process, he also utilized treasury shares purchased in the past.

Choi Yoon-beom, Chairman of Korea Zinc, and Jang Hyung-jin, Advisor to Youngpung (from left)

The conflict between the two families is ongoing. In April, Korea Zinc decided not to renew its 20-year contract with Youngpung to handle sulfuric acid, and in June, Youngpung responded with a lawsuit.

If Korea Zinc continues to perform above expectations under Choi Yoon-beom, the remaining shareholders are likely to support the current management. In fact, the National Pension Service, the second largest shareholder with a 7.8% stake in Korea Zinc, also voted for the agenda posted by the management at this year's general shareholders' meeting where the two families competed.

Gwak Horyung (horr@fntimes.com)

![김종현 쿠콘 대표 출마…김동호 KCD·최종원 헥토파이낸셜 대표 하마평 [핀테크산업협회장 선임 레이스]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260106224614021108a55064dd118222261122.jpg&nmt=18)

![[DCM] 한화에어로, 확고한 진입장벽…현금흐름 우려 불식 ‘자신감’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010623075501402a837df6494123820583.jpg&nmt=18)

![김성식 예보 사장, 전문성 우려 딛고 7일 취임식...노조와도 합의 [2026 금융공기업 CEO 인사]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010617150207693b4a7c6999c121131189150.jpg&nmt=18)

![[카드뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 조금 느려도 괜찮아...느림 속에서 발견한 마음의 빛깔](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=20251105082239062852a735e27af12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)