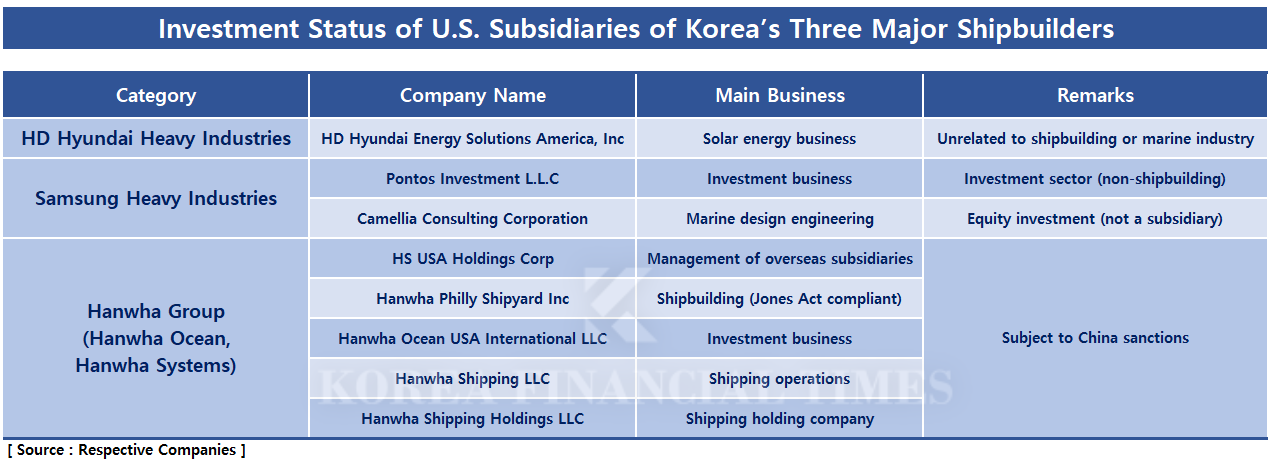

HD Korea Shipbuilding & Offshore Engineering, the intermediate holding company for HD Hyundai's shipbuilding division, has two US subsidiaries: HD Hyundai Energy Solutions America, Inc and Pontos Investment L.L.C.

HD Hyundai Energy Solutions America operates solar power businesses, while Pontos Investment is an investment company. Both lack direct connections to shipbuilding and offshore operations, reducing the likelihood of Chinese sanctions.

Samsung Heavy Industries holds a partial stake in US marine design engineering firm Camellia Consulting Corporation, but it is not a subsidiary. Since the company is not under direct control, Samsung Heavy effectively has no US shipbuilding-related entities.

In contrast, five Hanwha Group shipbuilding and offshore affiliates received Chinese sanctions yesterday. All forms of transactions, cooperation, and exchange activities with Chinese organisations or individuals are prohibited. China's Ministry of Commerce invoked the Anti-Foreign Sanctions Law, determining these companies threatened Chinese sovereignty, security, and development interests.

Sanctioned entities include HS USA Holdings Corp, Hanwha Philly Shipyard Inc, Hanwha Ocean USA International LLC, Hanwha Shipping LLC, and Hanwha Shipping Holdings LLC.

HS USA Holdings is a US subsidiary wholly owned by Hanwha Systems, managing overseas subsidiaries. HS USA Holdings owns 60 percent of Hanwha Philly Shipyard. Hanwha Ocean USA International, fully funded by Hanwha Ocean, operates investment businesses in the US. Hanwha Shipping and Hanwha Shipping Holdings are Hanwha Ocean's grandson and great-grandson companies respectively.

However, these Chinese sanctions are unlikely to directly damage Hanwha Philly Shipyard and Hanwha Shipping operations. Currently, neither company maintains substantive cooperation with China.

The 10 medium-range petroleum and chemical product carriers (MR P/C) and three feeder container ships under construction at Hanwha Philly Shipyard are all vessels for operations centred on American coastal routes. Under the US Jones Act, they are used solely for domestic US transportation and do not utilise Chinese labour, technology, materials, or financing.

While shipbuilders sometimes purchase Chinese thick plates (steel), vessels ordered by Hanwha Philly Shipyard use thick plates sourced from the US, Canada, and Mexico instead of Chinese materials, eliminating impact.

Lee Ji-ni, analyst at Daishin Securities, explained: "The likelihood of expanded sanctions on thick plates is low because it becomes a chicken game for both China and Korea. With China's economic stimulus measures weak, Korean shipbuilders serve as reliable purchasers for Chinese steelmakers. If sanctions expand, Chinese steel companies would suffer damage comparable to Korean shipyards."

Hanwha Ocean and Hanwha Systems also appear unlikely to face significant sanctions impact, as neither operates direct businesses within the US. China's Ministry of Commerce announcement made no mention of sanctions on parent companies.

Kang Kyung-tae, analyst at Korea Investment & Securities, analysed: "This measure represents backlash against the US decision to impose port fees on China-related vessels, and dissatisfaction with Korean companies assisting US shipbuilding revival as the largest competitor in global shipbuilding."

Lee Dong-hean, research fellow at Shinhan Investment & Securities, noted: "Chinese shipyards' order backlogs have surged dramatically over the past three years, and according to shipowners' requirements, they cannot manufacture all vessels without assistance from Korean shipbuilding industries such as engines."

However, some raise concerns about potential expansion of Chinese sanctions across Korea's shipbuilding industry.

Lee Jae-hyuk, analyst at LS Securities, projected: "We need to consider the possibility of additional China-originated sanctions expanding to domestic and Japanese shipyards cooperating with the US Navy. If sanctions expand, they will create potential negative impacts on domestic shipyard commercial vessel order activities."

He added: "We need to closely monitor the possibility of expanding concerns among global shipowners regarding orders for Korean-built vessels."

Indeed, following the US Trade Representative's (USTR) announcement of maritime sanctions against China, major container shipping companies including Japan's Ocean Network Express (ONE) and Germany's Hapag-Lloyd examined switching orders from Chinese to Korean shipyards.

A shipbuilding industry official stated: "We view these sanctions as warning measures and are closely monitoring the situation."

Shin Haeju (hjs0509@fntimes.com)

![[금융가Talk] SBI저축은행, '올해의 SBI인' 대상에 최초 개인직원이 받은 배경은](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024032422091902574dd55077bc22109410526.jpg&nmt=18)

![[DCM] HD현대오일뱅크, 정제마진 개선 의미와 신용도 재평가](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020306545306387a837df6494123820583.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)