Hanwha Ocean stated during its 2025 second-quarter earnings conference call on the 29th that regarding HD Hyundai Heavy Industries being selected as the preferred negotiation partner for the ‘Jangbogo-II’ performance upgrade system development project, “Only the evaluation scores have been released so far; we will formulate our response once more detailed information becomes available.” He added, “We will thoroughly prepare for the Jangbogo-III project to secure Hanwha Ocean’s competitive edge in the submarine business.”

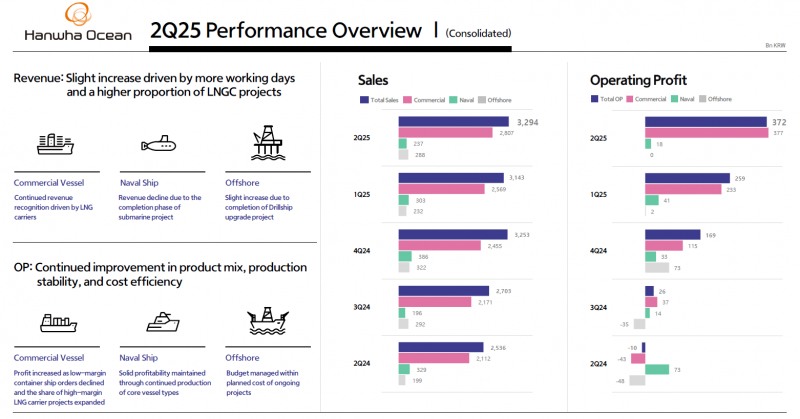

For the second quarter, Hanwha Ocean reported consolidated sales of KRW 3.2941 trillion and operating profit of KRW 371.7 billion. Sales increased 29.9% year-on-year, and operating profit swung to the black from a KRW 9.7 billion deficit in the same period last year.

Shin Yong-in, Executive Vice President and CFO at Hanwha Ocean, cited increased working days and a higher share of liquefied natural gas (LNG) carriers—which are more profitable—as the main drivers of earnings growth for the quarter. “Operating profit also benefited from a lower proportion of low-margin container ship sales,” he said.

By business segment, Hanwha Ocean’s commercial ship sales totaled KRW 2.8068 trillion, special-purpose ships generated KRW 236.8 billion, and offshore sales amounted to KRW 288.1 billion in the second quarter. Compared to the same period last year, sales of commercial ships were up 9%, while offshore revenue surged 24%. In contrast, sales in the special-purpose ship division declined by 22% year-on-year.

Operating profit also varied by segment. The commercial ship division posted KRW 377.1 billion in operating profit, marking a 62% increase from a year earlier. Special-purpose ships generated KRW 18.3 billion in operating profit, representing a sharp 56% decrease, while the offshore segment reported just KRW 200 million, plunging 93% year-on-year.

The commercial ship division typically accounts for 70–80% of total sales, with LNG carriers making up about 60% of this segment. There was a one-time loss of KRW 50 billion from exchange rate fluctuations, mostly in the commercial ship and offshore divisions.

In the special-purpose ship division, both sales and operating profit decreased in Q2 as the construction of the lead ship for the “Jangbogo-III Batch-II” project neared completion.

However, with cost input for the second vessel of “Jangbogo-III Batch-II” set to ramp up from the second half, the company expects sales of about KRW 300 billion each in the third and fourth quarters. In shipbuilding, revenue is recognized progressively according to construction progress.

Choi Jung-hoon, Executive Director of Special Ship Planning at Hanwha Ocean, said, “We are formally pursuing participation in the Canadian Navy’s next-generation submarine program.” He explained, “The project, expected to involve 8 to 12 submarines, could reach up to KRW 60 trillion in total value when including maintenance, repair, and overhaul (MRO) contracts.”

Choi added, “We decided in June to establish a local subsidiary in Canada,” and noted, “Last week, a member of the National Assembly’s Defense Committee visited Canada as a special envoy of the President, so government-level diplomatic support is also ongoing.”

Regarding efforts to win additional MRO contracts for the U.S. Navy, he commented, “We are still submitting other proposals. While meeting our goal of six ships this year may be difficult, we will continue our efforts.”

Meanwhile, Hanwha Ocean expects a one-off cost of KRW 25 to 30 billion in the third quarter as a result of concluding 2025 wage negotiations with its labor union on July 24.

Shin Haeju (hjs0509@fntimes.com)

![[금융가Talk] SBI저축은행, '올해의 SBI인' 대상에 최초 개인직원이 받은 배경은](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2024032422091902574dd55077bc22109410526.jpg&nmt=18)

![[DCM] HD현대오일뱅크, 정제마진 개선 의미와 신용도 재평가](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020306545306387a837df6494123820583.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)