According to the financial investment industry on the 21st, HL Holdings held a board meeting on the 11th and approved an agenda to donate 470,193 shares of its own shares to a non-profit foundation to be established in the future. The company says the decision was made to fulfill its social responsibility.

These represent 83.8% of the 560,720 shares of its own shares purchased throughout 2020 and 2021 to enhance shareholder value. Although it emphasized ‘increasing shareholder value,’ it is a case of breaking its own promise.

The purchase of own shares itself only partially helps increase shareholder value. Since own shares do not have voting rights and therefore do not pay dividends, repurchasing own shares results in increasing the dividend yield per share. If the voting rights are revived through the sale or donation of own shares instead of cancellation, the dividend yield is likely to decrease again.

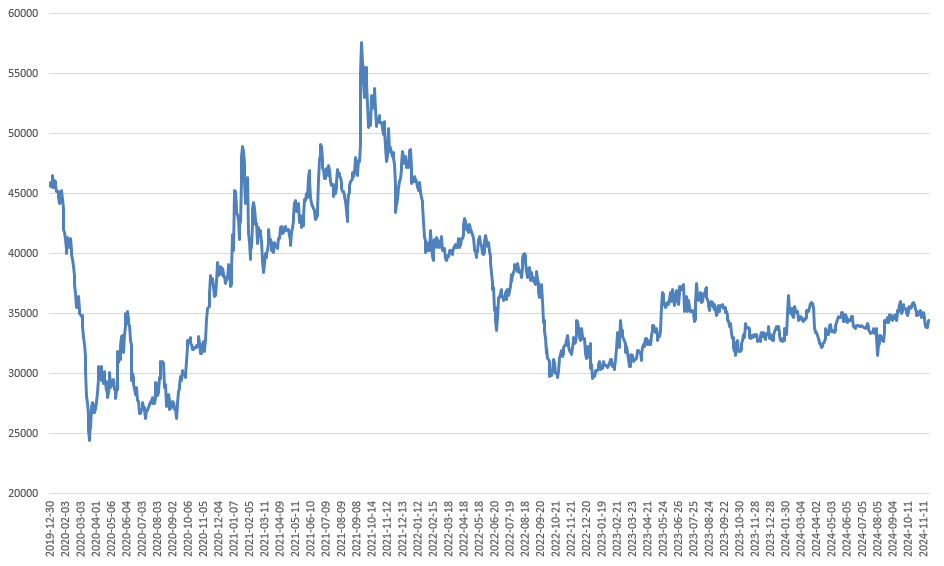

The Korea Financial Times calculated the cumulative total shareholder return rate (TSR) of HL Holdings from January 2020 to the present through the data platform Deep Search, and the result was -7.63%. During this period, HL Holdings' stock price fell 25.05%, and the cumulative dividend yield was 17.43%.

While the stock price continued to fall, it defended the stock price decline by paying a dividend of 2,000 won per share every year. Unless the total dividend amount is increased, the power that supported the TSR may weaken if the treasury share voting rights are revived.

Holding company discounts, Free transfer of own shares… Shareholders suffer ‘double pain’

In the domestic market, holding companies tend to have high discount rates. In order to increase shareholder value, the intensity of shareholder return should be higher than that of a normal business company. HL Holdings’ PBR(price-to-book value ratio) has been moving at the level of 0.3 to 0.5 times for the past five years. Recently, it has been trading at a level slightly above 0.3 times, which is far from a value-up.In particular, in a situation where ‘corporate value-up’ is being promoted by the government and financial authorities, HL Holdings’ free transfer of shares is running counter to this.

The source of funds for treasury stock purchases is the company’s cash assets. HL Holdings’ decision to free transfer of shares is equivalent to purchasing treasury stocks with corporate funds and then transferring them to a foundation without any compensation. From a shareholder's perspective, HL Holdings has abused the company's funds.

In particular, shareholders’ opposition is bound to be even stronger because the dividend yield is maintained and the value per share increases when treasury stocks are cancellated.

It is also being reexamined that Chairman Chung Mong-won’s stake is only 25.03%. Even considering the stakes of special related parties (including KCC), it is slightly over 30%. This is why some are pointing out that the free transfer of shares is intended to secure friendly shares for the largest shareholder.

Lee Sungkyu (lsk0603@fntimes.com)

![[DQN] BNK금융, 비이자 성장 돋보였지만 지속성 고민…JB, 충당금에 ‘발목’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026011913504200298b4a7c6999c121131189150.jpg&nmt=18)

![[DCM] CJ제일제당·삼양사·대한제당, 가격담합으로 부풀려진 신용등급](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022013425808632a837df6494123820583.jpg&nmt=18)

![[DQN] NIM '개선' 하나은행, '사수' 우리은행···어떻게 다를까 [금융사 2025 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021919405809779b4a7c6999c121131189150.jpg&nmt=18)

![토스증권, 해외주식 신흥강자로 영업익 업계 9위 '우뚝' [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022015114702246179ad4390712813480118.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)