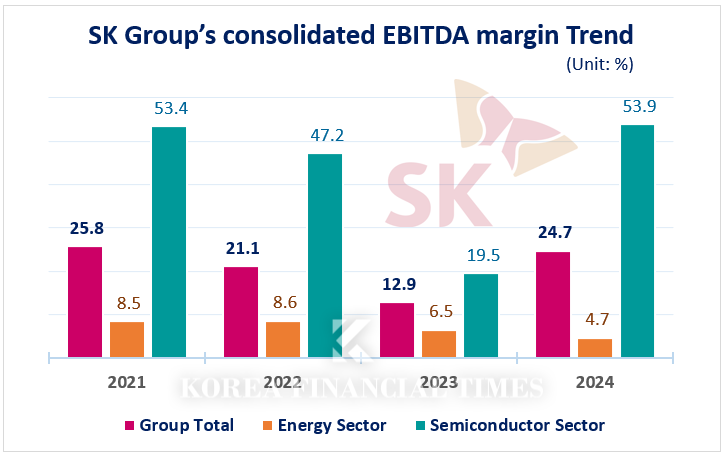

According to the Korea Ratings data package, SK Group’s consolidated EBITDA margin reached 23.8% in 2024, nearly doubling from 12.3% in 2023 in just one year.

The EBITDA margin is the ratio of EBITDA to sales revenue. While similar to the operating profit margin, it reflects profitability excluding depreciation, interest expenses, and taxes, thus indicating the actual cash-generating capability.

* Energy Sector = SK Innovation, SKC, SK Gas, SK Chemicals, SK Advanced ; * Semiconductor Sector = SK hynix, SK Siltron / Data Source: Korea Investors Service, Inc.(KIS) Data Package

이미지 확대보기SK Group’s main concern is the pronounced reliance on semiconductors. The EBITDA margin of semiconductor affiliates such as SK hynix and SK siltron surged from 19.5% in 2023 to 53.9% in 2024. In contrast, the EBITDA margin of the energy affiliates, which account for the largest portion of sales, declined from 6.5% to 4.7% over the same period.

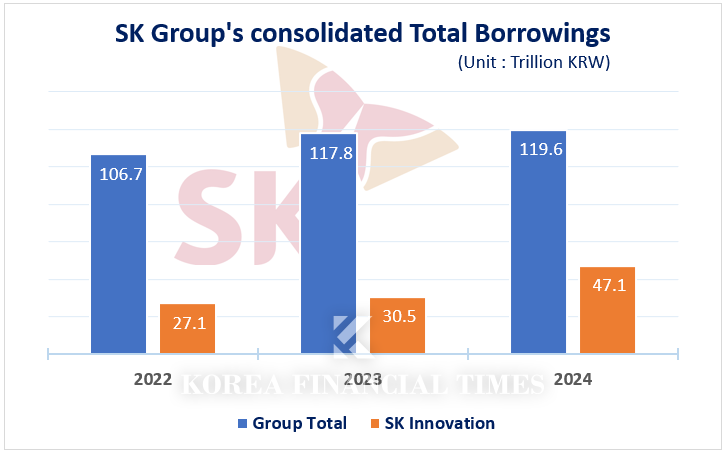

SK innovation, which accounts for 81% of sales among SK’s energy affiliates, is experiencing poor performance across all major business segments, including refining, chemicals, and batteries. As a result, even though its cash generation capacity is weakening, it faces a structural burden to continue large-scale investments such as battery facility expansions.

Consequently, dependence on external financing has increased, leading to a vicious cycle of expanding borrowings.

In fact, SK innovation’s consolidated total borrowings surged by approximately 54%, from KRW 30.535 trillion in 2023 to KRW 47.129 trillion in 2024.

The merger of SK innovation with SK E&S, which has strong cash generation capacity, in November last year was also a measure to overcome its financial crisis. Subsequently, in February this year, three SK innovation affiliates—SK on, SK Enterm, and SK International Trading—also underwent mergers. However, with SK on expected to remain in the red this year due to the prolonged EV market downturn, concerns are rising that additional support measures may be necessary.

Gwak Horyung (horr@fntimes.com)

![‘리니지 제국'의 부진? 엔씨의 저력을 보여주마 [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020123095403419dd55077bc211821821443.jpg&nmt=18)

![[DCM] 한화시스템, FCF 적자 불구 시장조달 자신감](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020204171101504a837df6494123820583.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)