The spike was triggered by rumors circulating in Yeouido’s financial district about a potential health issue concerning Chung Mong-koo, Honorary Chairman of Hyundai Motor Group. The speculation was later debunked, and the stock price quickly returned to normal.

Although the incident was dismissed as a brief stir, its aftermath highlighted two key points: Chung Mong-koo’s advanced age of 87, and the market’s heightened expectations around Hyundai Mobis in relation to the group's succession and corporate governance restructuring.

The reason Hyundai Mobis stock is so sensitive is because the company sits at the apex of Hyundai Motor Group’s governance structure. The group operates under a circular shareholding arrangement involving Hyundai Mobis → Hyundai Motor Company → Kia → (Hyundai Steel) → Hyundai Mobis.

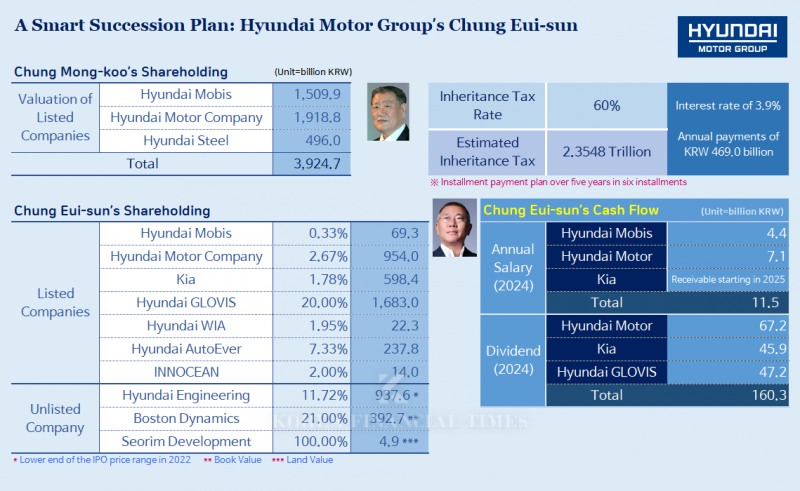

While Chung Eui-sun has effectively led the group since 2018, he has yet to inherit the key stakes in core affiliates. As of now, Chung Mong-koo holds 7.29% of Hyundai Mobis, 5.44% of Hyundai Motor Company, and 11.81% of Hyundai Steel. In contrast, Chung Eui-sun holds just 0.32% of Hyundai Mobis, 2.67% of Hyundai Motor Company, and 1.78% of Kia.

One might assume that gaining control of Hyundai Mobis would resolve the succession issue. However, under the circular shareholding structure, a vulnerability in any one affiliate could potentially destabilize the entire chain of control.

Therefore, to complete the succession process, Chung Eui-sun must inherit his father’s shares. Dismantling the circular structure would come later.

The problem lies in South Korea’s excessively high inheritance tax rate. The top marginal rate is 50%.

Moreover, a 20% premium is applied when stocks are inherited, pushing the effective top rate up to 60%.

As a result, many conglomerate leaders explore various strategies to minimize tax burdens. Hyundai Motor Group’s 2018 restructuring plan, which involved a spin-off and merger between Hyundai Mobis and Hyundai Glovis, faced backlash for this very reason. Foreign investors argued that the merger ratio unfairly favored Hyundai Glovis, where Chung Eui-sun was the largest shareholder, ultimately causing the plan to collapse.

Seven years have passed since then, yet the group's governance reform remains unresolved. Still, market confidence is high that Hyundai Motor Group—now a global company—will avoid any strategy that harms shareholder value.

At this point, what might Hyundai Motor Group’s “smart succession plan” look like? Chung Eui-sun is widely expected to pursue a direct and transparent approach—accepting the inheritance and paying the necessary taxes.

However, considering Korea’s high inheritance tax rate, the amount Chung would owe is staggering.

As of the closing prices on April 16, the value of Chung Mong-koo’s shares in key affiliates amounts to KRW 1.5099 trillion (Hyundai Mobis), KRW 1.9188 trillion (Hyundai Motor), and KRW 0.496 trillion (Hyundai Steel), totaling KRW 3.9247 trillion.

At a 60% inheritance tax rate, this would result in a tax burden of approximately KRW 2.3548 trillion.

Chung Eui-sun can utilize the installment payment system for inheritance tax, which allows payments over five years.

Factoring in a 3.9% interest rate, he would need to pay KRW 470 billion annually. Even for a conglomerate heir, this is a formidable sum. Known sources of Chung’s cash flow include his salary and dividends. Last year, he earned KRW 11.5 billion in salary and KRW 160 billion in dividends, totaling around KRW 180 billion before taxes.

To ease the burden, he may also tap into shares from affiliates unrelated to the group’s governance structure, such as Hyundai Engineering and Boston Dynamics.

Let’s first look at Hyundai Engineering. He owns 11.72%, and Chung Mong-koo holds another 4.68%.

At the time of its IPO attempt in 2022, Hyundai Engineering was valued at approximately KRW 8 trillion. The combined stake of 16.4% would thus be worth about KRW 1.31 trillion. However, due to lackluster investor interest, the IPO was canceled, and given the current construction downturn, the company's valuation is likely lower today.

Another key asset is Hyundai Glovis, in which Chung holds a 20% stake. Based on recent closing prices, this stake is valued at KRW 1.68 trillion. If the group’s robotics business succeeds, the value of Hyundai Glovis could increase further.

Boston Dynamics, which was acquired from SoftBank in 2020, could become a source of hope. Hyundai Glovis also participated in the acquisition and secured a 10% stake.

Unlike Hyundai Glovis, which has been criticized for high intra-group transaction reliance, the robotics business is a new business Chung Eui-sun personally discovered and is nurturing. This makes it a legitimate source of succession funding. Chung holds 21.9% of Boston Dynamics and contributed KRW 239 billion of his own funds for the acquisition.

Since Boston Dynamics is unlisted, estimating its market value is difficult. As of last year, its book value stood at only KRW 1.87 trillion. Although its IPO was scheduled for this June under an agreement with SoftBank, its ongoing losses make the listing uncertain.

Still, brokerages project the Boston Dynamics’s valuation to range from KRW 4 trillion to as high as KRW 30 trillion, depending on growth prospects. Assuming a valuation of KRW 10 trillion, Chung’s stake alone would be worth over KRW 2 trillion—enough to significantly ease the inheritance tax burden.

Chung’s other major next-generation venture, autonomous driving, also deserves attention. Hyundai AutoEver, responsible for software development in this field, is a key player. Chung holds a 7.33% stake, currently valued at approximately KRW 220 billion based on the current share price.

Gwak Horyung (horr@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)