The Narendra Modi administration in India recently implemented the largest Goods and Services Tax (GST) reform in eight years, introducing significant tax cuts. The GST, introduced in 2017, categorizes various goods and services into four slabs, levying taxes at 5%, 12%, 18%, and 28%.

Under the revised GST, the 28% tax rate applied to automobiles and electronics will be abolished starting from October. Additionally, consumer goods, including packaged foods, will see their tax rate reduced from the existing 12% to 5%.

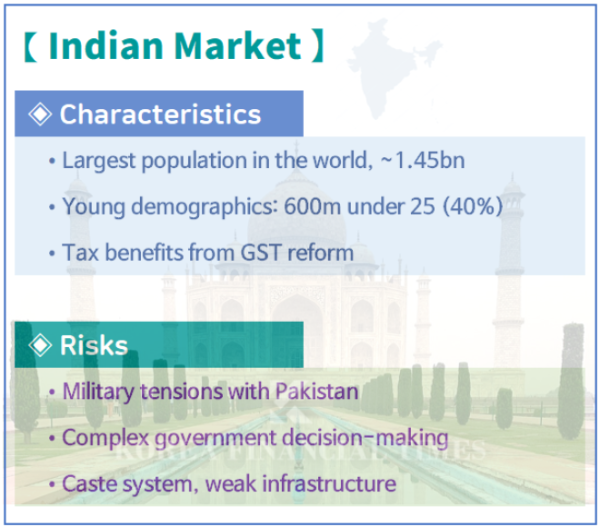

The Modi administration's decision to reform the GST aims to invigorate the domestic market and encourage foreign investment in response to the high-tariff policies of the US Trump administration. India became a target for ultra-high tariffs of 50% following approximately five failed rounds of trade negotiations with the United States. This represents the highest tariff level among all US trading partners.

With the Indian government actively courting businesses, India is emerging as a compelling choice for South Korean companies seeking new strategic locations amidst US-China trade tensions and the Trump administration's tariff policies.

India remains a market with clear risks and variables, including armed conflicts with Pakistan, inadequate infrastructure, the caste system, and a complex government decision-making structure.

A notable example is the South Korean gaming company Krafton, which achieved national success in India through "Battlegrounds Mobile India." However, in 2022, the service was unilaterally suspended by the Indian government. The prevailing analysis at the time suggested this was due to Tencent, the game's publisher, being a Chinese company, given the ongoing friction between India and China. The service was only successfully resumed in May 2023.

Despite the clear risks and variables, South Korean companies maintain that they cannot overlook the growth potential of a nation with the world's largest population. India's population stands at approximately 1.45 billion, with about 40% (600 million) of its potential economic population falling into the under-25 age group, indicating a massive domestic market. The country also boasts an abundant supply of future R&D talent, particularly in IT.

Consequently, chairpersons of major South Korean corporations have demonstrated keen interest, making direct visits to India this year. LG Group Chairman Koo Kwang-mo chose India for his first overseas trip of the year in February. Lotte Group Chairman Shin Dong-bin also visited India for his first overseas business engagement in February this year. Last year, Samsung Electronics Chairman Lee Jae-yong and Hyundai Motor Group Chairman Chung Eui-sun personally inspected local production bases in India.

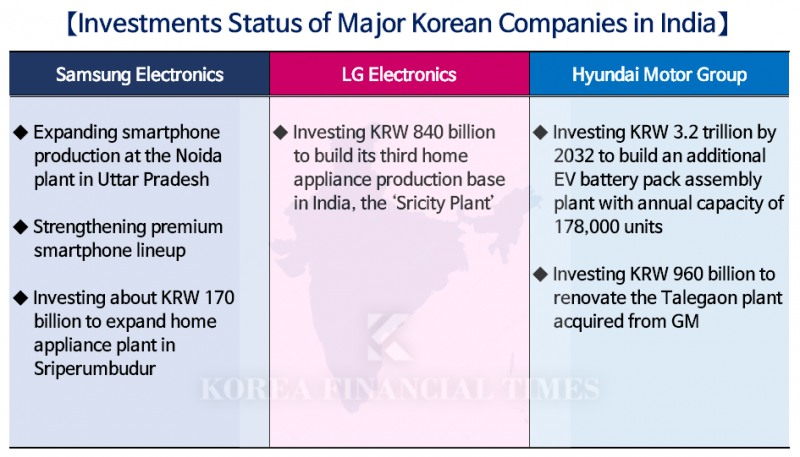

Reflecting the determination of their leaders, major South Korean companies already with a presence in India, such as Samsung Electronics, LG Electronics, and Hyundai Motor, have announced local investment plans for the second half of this year, expanding local sales and production.

Samsung Electronics is aiming to expand its smartphone sales in India. According to market research firm IDC, Samsung captured a 49% share of India's 'super-premium smartphone' market (priced above 70,000 rupees, approximately KRW 1.1 million) in the first half of this year, slightly outpacing Apple (48%). The strong sales of its Galaxy S25 Ultra and Galaxy S24 Ultra models were particularly instrumental.

Furthermore, Samsung Electronics announced an investment of approximately KRW 170 billion this year in its Sriperumbudur factory in India, which produces home appliances. This move is intended to fully scale up its home appliance business within the Indian market.

LG Electronics, known as a "national appliance company" after 28 years of operation in India, is currently constructing its third local production base, the Sri City factory, following its existing Noida and Pune plants. This factory, scheduled for completion in the second half of this year, involves a total investment of approximately USD 600 million (KRW 840 billion).

Hyundai Motor is rebuilding the Talegaon plant, which it acquired from GM last year in the Pune region, with an investment of KRW 960 billion. Additionally, it plans to invest KRW 3.2 trillion by 2032 to construct an additional factory capable of assembling 178,000 electric vehicle battery packs annually. Hyundai Mobis is also building a localized component ecosystem, recently completing an EV battery system assembly plant in Sriperumbudur.

POSCO Group, seeking a breakthrough in the steel industry, is also eyeing opportunities in India. POSCO announced on the 18th that it signed a Non-Binding Heads of Agreement (HOA) with JSW Group, India's top steel company, in Mumbai for full-fledged business cooperation.

Through the HOA, the two companies moved beyond the 'MOU on Business Cooperation in Steel and Secondary Battery Materials' signed in October last year, further concretizing cooperation plans, including the location for an integrated steel mill, production scale, and equity structure.

For the integrated steel mill, Odisha state in India, rich in natural resources like coal and iron ore and offering competitive raw material procurement, has been selected as a primary candidate site. The final site will be determined after a joint feasibility study.

The scale of the steel mill has been expanded to 6 million tons of crude steel production, up from the 5 million tons considered last year. This decision stems from the judgment that more proactive market penetration is needed in the emerging growth market, given India's steel consumption has sharply increased by 9-10% in the last three years. The equity structure will be an equal partnership, with each company holding a 50% stake.

In addition, Lotte Group is expanding its local operations, having completed a new factory for its local subsidiary Havmor (ice cream) and pursuing a merger with its existing Indian subsidiary, Lotte India.

Notably, India has also been chosen as the first overseas production base for "Pepero," a popular snack locally, aiming to nurture it into a global brand. Production of Pepero is scheduled to begin in the second half of this year at the Haryana factory in India, built with an investment of approximately KRW 33 billion.

Kim JaeHun (rlqm93@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)