Through last month, the company had issued a total of KRW 380 billion in commercial paper (CP). By March, the company had repaid KRW 70 billion of CPs that had matured, leaving a current outstanding balance of KRW 310 billion. All of the CPs issued so far have a maturity of six months or less.

“The purpose of issuing CPs is to raise operating funds,” said a company official.

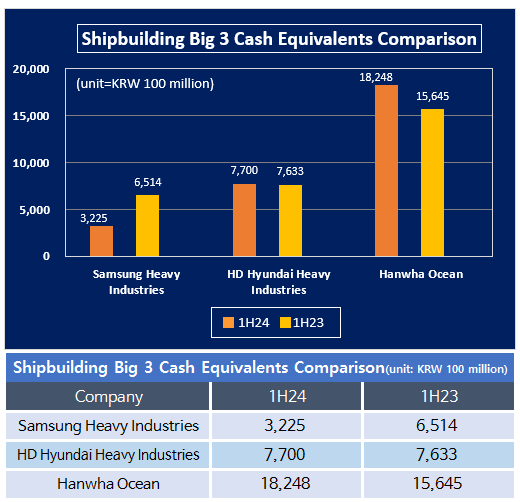

Graphing and tabulation = Korea Finacial Times Finance Institute

Samsung Heavy Industries's borrowings in the first half of this year totaled KRW 3.62 trillion, up 14.3% year-on-year. During this period, short-term borrowings increased, while long-term borrowings decreased. Short-term borrowings increased by 18.4% to KRW 2.2 trillion over the year, while long-term borrowings decreased by 36.7% to KRW 197.2 billion.

The continued borrowing is linked to the increase in orders. Typically, shipbuilders receive ship contracts in installments depending on the stage of construction, but the initial down payment is not enough to complete the construction of a ship, so they need to raise funds through bank loans or issuance of corporate bonds in the interim. As the number of orders increases, the company has no choice but to continue borrowing externally.

To date, Samsung Heavy Industries has secured orders for 24 ships totaling $5.4 billion (about KRW 7.3 trillion), achieving 56% of its order target of $9.7 billion (about KRW 13.1 trillion) for the year. The backlog to date stands at $31.9 billion(about KRW 43.1 trillion), representing more than three years of work.

The company recently signed a KRW 678.3 billion contract with an Asian shipowner for the construction of two liquefied natural gas (LNG) carriers. The vessels are scheduled to be delivered to the shipowners sequentially through April 2027.

“While the working capital burden will persist for the time being due to an expanded order backlog compared to the past, cash inflows from improved profitability and increased delivery volumes will ease the borrowing burden in the future,” said Park Hyun-joon, head researcher at Nice Credit Ratings' Corporate Assessment Department, in a recent report on the shipbuilding industry.

Shin Haeju (hjs0509@fntimes.com)

![[DQN] 상상인플러스저축은행, NPL비율 24.74% 1위...SBI·페퍼 건전성 개선세 [2025 1분기 저축은행 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250701012406014906a663fbf34175192139202.jpg&nmt=18)

![성대규號 동양생명, CFO·CIO 키워드 '신한'…재무·인사·방카슈랑스 후선인사 촉각 [우리금융 동양·ABL생명 인사]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250702212056085978a55064dd12101238196.jpg&nmt=18)

![[DCM] ‘강경 대응’ 트러스톤, 화근이 된 태광산업 ‘거짓 10조 투자’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025070223512301088dd55077bc25812315225.jpg&nmt=18)

!['유예기간' 얻은 MG손보, 재매각 추진하지만…인수 가능성 사실상 없어 [MG손보 폐업 수순]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20250630173748036579efc5ce4ae1439255137.jpg&nmt=18)

![[인사] 제주은행](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025070210062800874300bf52dd2121131180157.jpg&nmt=18)

![턴어라운드 다올투자증권, 내실 다지기 속도 [강소(强小) 증권사 향해 뛴다 (2)]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025070117433607673179ad439071182352157.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[카드뉴스] 국립생태원과 함께 환경보호 활동 강화하는 KT&G](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202403221529138957c1c16452b0175114235199_0.png&nmt=18)

![[카드뉴스] 신생아 특례 대출 조건, 한도, 금리, 신청방법 등 총정리...연 1%대, 최대 5억](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=20240131105228940de68fcbb35175114235199_0.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 지속 가능 경영, 보고와 검증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025011710043006774f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 똑똑한 금융생활...건전한 투자와 건강한 재무설계 지침서](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025031015443705043c1c16452b012411124362.jpg&nmt=18)

![[AD] ‘상품성↑가격↓’ 현대차, 2025년형 ‘아이오닉 5’·‘코나 일렉트릭’ 출시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202505131018360969274925877362115218260.jpg&nmt=18)

![[AD] 현대차 ‘아이오닉9’·기아 ‘EV3’, ‘2025 탑기어 전기차 어워즈’ 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202505091106510520874925877362115218260.jpg&nmt=18)

![[카드뉴스] KT&G ‘Global Jr. Committee’, 조직문화 혁신 방안 제언](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202503261121571288de68fcbb3512411124362_0.png&nmt=18)

![[AD] 기아, 혁신적 콤팩트 SUV ‘시로스’ 세계 최초 공개](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113461807771f9c516e42f12411124362.jpg&nmt=18)

![[AD] 아이오닉5 '최고 고도차 주행 전기차' 기네스북 올랐다...압도적 전기차 입증](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=2024123113204707739f9c516e42f12411124362.jpg&nmt=18)