Former U.S. President Donald Trump

In an interview with Bloomberg Businessweek on Saturday (U.S. time), the president said of the IRA, “Electric vehicles are great,” but “we can't go 100 percent electric.”

He had previously pledged to repeal the IRA subsidy early last year, saying he would “end the Biden electric vehicle mandate” in Agenda Item 47 of his re-election campaign.

The IRA, which was implemented by the Biden administration in 2022, provides subsidies of up to $7500 for EVs that are finalized in North America.

The IRA also included an incentive for battery manufacturers, the Advanced Manufacturing Production Credit (AMPC). It provides $45 per kWh of North American-made battery cells and modules in EVs sold locally.

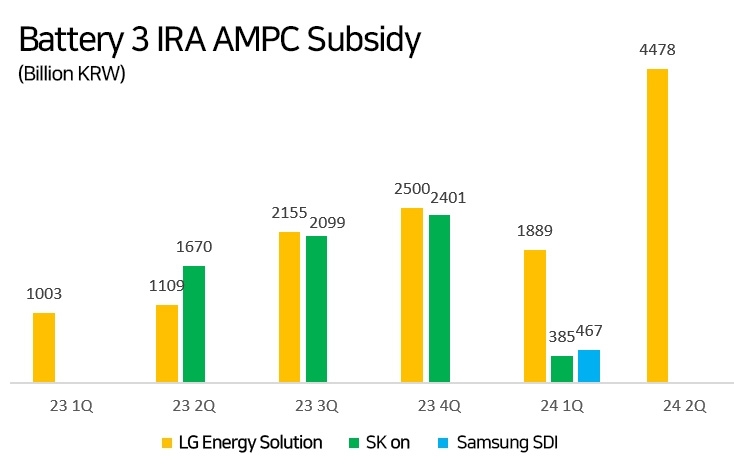

Korean battery companies have benefited directly from the AMPC.

LG Energy Solutions received an AMPC subsidy of 67.68 billion won last year. This year, the benefit amounted to 188.9 billion won in the first quarter and 447.8 billion won in the second quarter. The subsidies have helped the company narrowly avoid operating losses.

SK energy also recognized AMPC benefits totaling 61.7 billion won last year. In the first quarter of this year, the subsidy was reduced to 38.5 billion won due to the suspension of Ford F150 Lightning production, resulting in a large operating loss of 300 billion won.

Samsung SDI also announced that it recognized 46.7 billion won in AMPC subsidies in the first quarter. Samsung SDI does not yet have a battery cell manufacturing plant in the US. It is believed to have won the subsidy solely by supplying the US battery pack production facility to the US electric car company Livian.

Under the assumption that the EV market rebounds, the AMPC subsidy is expected to be even larger. Three domestic battery makers have announced large-scale expansion investments in the US. The industry estimates that the three companies' AMPC benefits could reach KRW 10 trillion in 2025 and KRW 20 trillion in 2026.

It is not an exaggeration to say that the U.S. subsidies will determine whether domestic battery companies, which have been struggling with slowing demand for electric vehicles, can rebound dramatically.

Battery companies are also keeping a close eye on Trump's re-election. Polls show Trump's chances of winning re-election have risen significantly to between 60 and 70 percent after he was shot during a campaign rally last week.

Gwak Horyung (horr@fntimes.com)

![[DQN] BNK금융, 비이자 성장 돋보였지만 지속성 고민…JB, 충당금에 ‘발목’](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026011913504200298b4a7c6999c121131189150.jpg&nmt=18)

![[DCM] CJ제일제당·삼양사·대한제당, 가격담합으로 부풀려진 신용등급](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022013425808632a837df6494123820583.jpg&nmt=18)

![토스증권, 해외주식 신흥강자로 영업익 업계 9위 '우뚝' [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022015114702246179ad4390712813480118.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)