◇ LG Display: Far to Go, But Preparing for a Leap

On June 6, LG Display announced it had repaid KRW 1 trillion borrowed from its parent company LG Electronics. When the loan was taken out in March 2023, it was scheduled for annual installment repayments through March 2026. However, LG Display repaid the loan nearly a year ahead of schedule.This process was not straightforward. In recent years, LG Display has become a concern within the group. Pressured by low-cost Chinese LCDs, the company accumulated over KRW 5 trillion in operating losses from 2022 to 2024.

Although LG Display began aggressively investing in small and medium-sized OLED panels for smartphones in the mid-2010s, the large-scale TV LCD business it had previously expanded took time to wind down.

Last November, the company sold its large LCD plant in Guangzhou, China, to CSOT, a subsidiary of China’s TCL Group. This marked a complete exit from the large LCD business.

The sale brought in KRW 2.2466 trillion. This inflow is expected to ease LG Display’s strained finances, which had been hit hard by accumulated losses and borrowings for OLED conversion.

LG Display’s decision to repay its loan early is seen as a move to reduce interest expenses. The annual interest rate on the loan from LG Electronics was 6.06%, less favorable than external sources like Korea Development Bank.

LG Display has also begun bold investments in OLED. On June 18, the company announced that its board had approved a KRW 1.26 trillion investment in new OLED technology, focusing on facilities at its Paju site.

This investment amount is nearly equivalent to the proceeds from the Guangzhou plant sale (KRW 2.2466 trillion) minus the repayment to LG Electronics (KRW 1 trillion).

Reinvesting much of the proceeds from the sale of the Chinese plant into domestic operations makes this a notable case of reshoring.

The company is quietly hoping for government support. In its investment announcement, LG Display stated, “This investment will contribute to the national economy by boosting collaboration with small partners and revitalizing local markets.”

Previously, the Ministry of Trade, Industry and Energy increased support for domestic reshoring companies (up to KRW 50 billion in government and local funds), reflecting the government’s eagerness to foster advanced industries. LG Display has also seen a turnaround, posting surprise operating profits of KRW 83 billion in Q4 last year and KRW 33 billion in Q1 this year.

However, it is still too early to say the financial crisis is over. At the end of Q1 this year, net debt stood at KRW 13.595 trillion. Cash and cash equivalents (including short-term financial products), even after the sale of the Chinese plant, totaled only KRW 2.4 trillion. LG Display stated, “We will continue efforts to improve our financial structure, regardless of investment plans.”

◇ Samsung Electronics: Investment Urgent, but Market Power and Cash Generation Not What They Used to Be

Samsung Electronics also borrowed a massive sum from an affiliate. According to its quarterly report, the KRW 21.99 trillion long-term loan from subsidiary Samsung Display matures on August 16—less than two months away.In February 2023, Samsung Electronics signed a KRW 20 trillion loan agreement with Samsung Display, with a lump-sum repayment at maturity and an option for early repayment. However, the loan amount has since increased, and no early repayment has been made.

At the time, Samsung Electronics faced a semiconductor downcycle and tightened cash flow, prompting the decision to borrow heavily from its affiliate.

In fact, net profit plummeted from KRW 55.65 trillion in 2022 to KRW 15.49 trillion in 2023, a 72% drop. Nevertheless, as a capital-intensive semiconductor manufacturer, the company cannot easily cut investment just because profits fall. Samsung Electronics’ capital expenditures (CAPEX) have shown a steady increase: KRW 53.1 trillion in 2022, KRW 53.1 trillion in 2023, and KRW 53.6 trillion in 2024.

An industry insider commented, “The memory semiconductor market cycles between booms and busts every four years. Given the expected upturn, borrowing from an affiliate was not a difficult decision.”

The problem is that Samsung Electronics now faces more than just a downturn. Amid recession and trade tensions from the Trump administration’s tariff wars, the only bright spot in semiconductors is AI, but Samsung Electronics has yet to capitalize on this trend.

Even its non-memory business, which the company has heavily invested in, is underperforming. NH Investment & Securities estimates that the system LSI (design) and foundry (contract manufacturing) divisions will post operating losses of KRW 4.2 trillion last year and KRW 5.4 trillion this year.

Still, Samsung Electronics is far from a financial crisis. As of the end of last year, its undistributed retained earnings (net profit minus dividends, capex, etc.) stood at KRW 146 trillion, making it a “cash-rich” company.

However, this figure is the sum of all overseas subsidiaries’ reserves and is not readily available for use by the domestic headquarters.

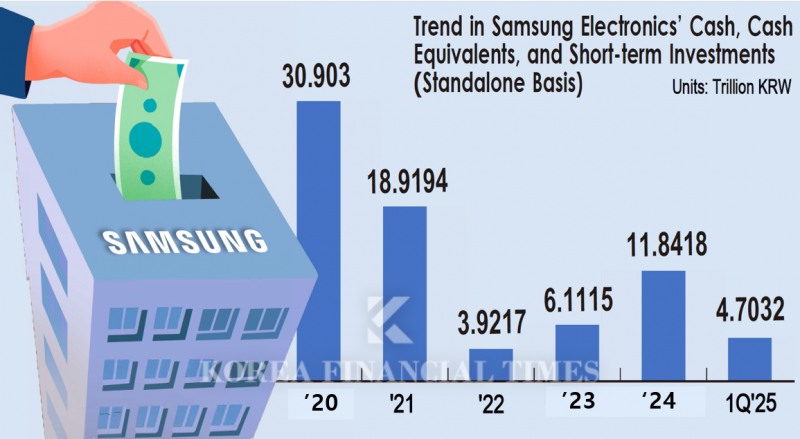

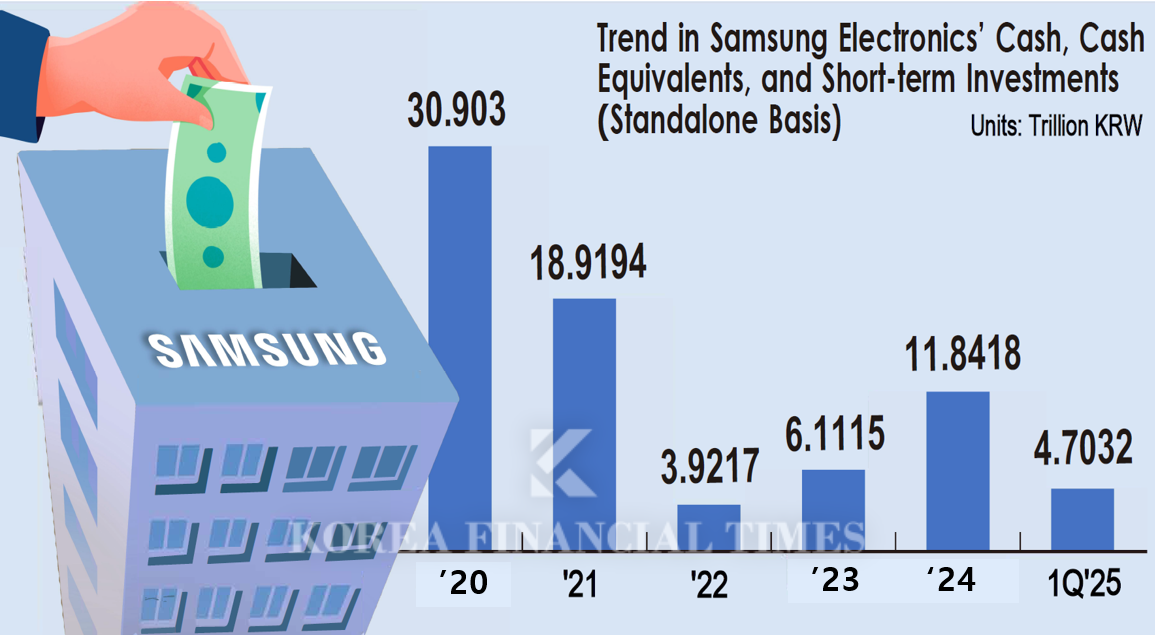

On a separate basis, Samsung Electronics’ cash and cash equivalents (including short-term financial products) stood at KRW 4.7032 trillion at the end of Q1 this year, down 75% from KRW 18.9194 trillion at the end of 2021. The company is not as flush as before. This is why Samsung Electronics borrowed KRW 2 trillion from Korea Development Bank last month.

The relatively relaxed position of the lender also eases the burden. According to Samsung Display’s 2024 separate audit report, its cash and cash equivalents (including short-term financial products) stand at KRW 13.7981 trillion. Although this is down about 14% from last year due to large-scale OLED investments, it is still solid. Samsung Display spends about KRW 5 trillion annually on facility investments.

Cash flow remains healthy. Operating profit was KRW 4.36 trillion in 2021, KRW 5.88 trillion in 2022, KRW 5.5 trillion in 2023, and KRW 3.68 trillion in 2024. While this year’s performance is declining, a rebound is anticipated in the second half as Apple, a key customer, launches new products.

An industry insider noted, “The interest rate agreed upon when Samsung Display lent KRW 22 trillion to Samsung Electronics was 4.6%, meaning annual interest alone is about KRW 1 trillion. Samsung Display is quietly smiling as it collects substantial interest.”

Gwak Horyung (horr@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)