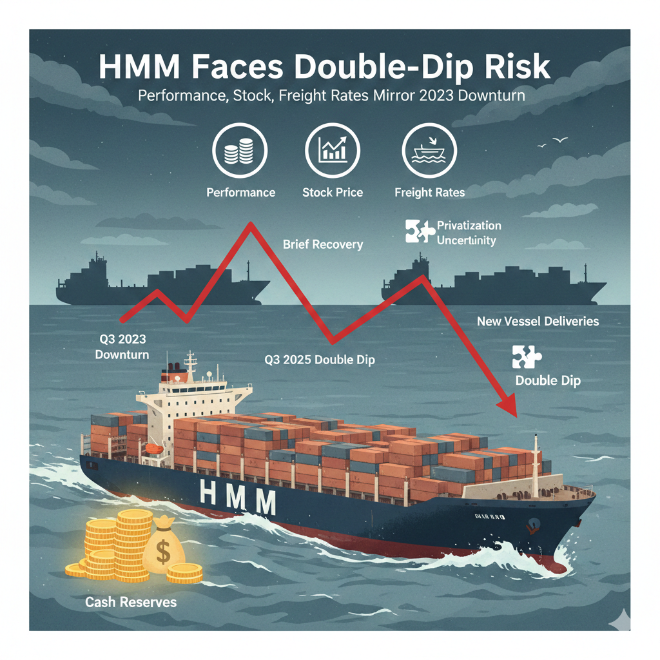

Even the privatization expectations that led to a stock price rebound in late 2023 are now acting as factors weighing down the stock price.

According to HMM's quarterly report, Q3 2025 revenue was KRW 2.7064 trillion and operating profit was KRW 296.8 billion, decreasing 24% and 80% respectively year-over-year. The Shanghai Containerized Freight Index (SCFI) fell from 1,763.49 in July to 1,114.52 in September. During the same period, the stock price also dropped from KRW 23,300 to KRW 20,050.

The problem is that this trend takes the form of a 'double dip,' emerging from recession, rebounding briefly, then returning to recession. This is almost identical to the 2023 pattern. HMM's Q3 2023 revenue was KRW 2.1266 trillion and operating profit was KRW 75.8 billion, down 58% and 97% respectively year-over-year. SCFI fell below the 1,000 mark, and the stock price also declined from the KRW 19,000 range to the KRW 16,000 range.

The gloomy Q4 performance outlook also resembles that period. Q4 2023 revenue was KRW 2.0628 trillion and operating profit was KRW 42.3 billion, down 3% and 44% respectively year-over-year. According to FnGuide consensus (securities firm estimates), HMM is expected to see Q4 2025 revenue of KRW 2.5255 trillion and operating profit of KRW 282 billion, down 20% and 72% respectively year-over-year.

SCFI rose to 1,550.70 on October 31 but fell to 1,451.38 as of November 14. In 2023, HMM recorded revenue of KRW 8.401 trillion and operating profit of KRW 584.8 billion, plunging 55% and 94% respectively year-over-year.

However, some view excessive concern as unnecessary since HMM's retained earnings as of the end of Q3 2025 stand at KRW 12.912 trillion, maintaining unprecedented cash reserves. Cash and cash equivalents at the end of Q3 were KRW 912.4 billion, maintaining the previous year's level.

An Do-hyun, an analyst at Hana Securities, stated, "HMM possesses KRW 12 trillion in liquidity, and despite declining container freight rates, depreciation costs are not significant, so performance stability is expected to be better than other shipping companies," adding, "Going forward, there is potential to strengthen performance stability through purchases of bulk carriers and tankers, and terminal investments based on cash assets."

The problem is that such liquidity effects may be limited if industry improvement does not accompany them.

According to a Korea Eximbank report, the container shipping market is unlikely to expect recovery next year as global economic slowdown and new vessel supply glut overlap.

Freight rates briefly jumped this year due to U.S. tariff issues, but as massive new vessels were released into the market all at once, rates plummeted again, causing SCFI to drop to the early 1,000 range. While new vessel delivery growth may temporarily slow next year, with no signs of cargo demand reviving due to U.S.-led trade disputes, it is analyzed that stopping the freight rate decline will not be easy.

The bigger problem is that large-scale new vessel deliveries will begin again after 2027, with vessel capacity (cargo loading capacity) expected to increase by an average of over 5% annually through 2028.

Particularly, with supply of large vessels over 12,000 TEU (1 TEU = one 20-foot container) expected to increase by more than 12% annually, there are significant concerns that transoceanic routes primarily served by large vessels will fall into long-term recession.

Concerns are also raised that if the Israel-Palestine conflict ceasefire ends the Red Sea crisis and Suez Canal passage normalizes, transoceanic route freight rates could experience 'catastrophic-level' recession.

Yang Jong-seo, a senior researcher at Korea Eximbank, explained, "Transoceanic shipping companies need to prepare for serious recession for about the next five years," and "Without the Red Sea crisis, the container shipping market would already be in a serious oversupply situation starting from 2024."

The privatization issue may also struggle to become a stock price upward momentum as in the past. While POSCO Group is known to be considering HMM acquisition, the analysis is that stock price rebounds may be limited if long-term fundamental deterioration and oversupply problems are not resolved.

HMM executed treasury stock cancellation on October 17, raising major shareholders Korea Development Bank and Korea Ocean Business Corporation's stake to 35.42% and 35.08% respectively, with the two institutions' combined stake exceeding 70%.

However, as perpetual bonds held by the two institutions converted to shares, the volume subject to sale also increased to over 70%, becoming a burden. While treasury stock cancellation reduced some sale burden, the fact that cash was consumed in the process is difficult to view positively.

HMM's number of issued shares increased 37% from approximately 690 million shares in 2023 to 943.23 million shares currently due to convertible bond (CB) conversion. While per-share value was diluted, market capitalization rose from the KRW 11-12 trillion range to the current KRW 18 trillion range. With increases in both stock price and issued shares enlarging corporate value, the analysis is that the same sale premium as in the past is difficult to expect. The current stock price is around the KRW 19,000 level, approximately 19% higher than the KRW 16,000 acquisition price proposed by Pan Ocean in 2023.

Choi Min-ki, an analyst at Shinhan Investment & Securities, emphasized, "Even considering idle cash, corporate value has become expensive, and it is not easy to be free from government intervention," and "There is a need to carefully approach whether sale news is unconditionally positive for the stock price."

Shin Haeju (hjs0509@fntimes.com)

![코스피 6300인데···KB금융, 12거래일 연속 외인 '순매도' 이유는 [금융지주 밸류업 점검]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022621383900871b4a7c6999c121131189150.jpg&nmt=18)

!['국장 ETF' 힘으로 코스피 상승…삼성운용 질주 [ETF 통신]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022608395305907179ad4390712813480118.jpg&nmt=18)

!['연임 특별결의' 도입 미룬 KB금융···'선제 조치' 타이틀 잡을 곳은 [2026 주총 미리보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022519321609304b4a7c6999c121131189150.jpg&nmt=18)

![[DCM] 삼성증권, 평균금리 낮은데 왜 꼴찌? [1월 리뷰④]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026022617292709746141825007d12411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)