Samsung Electronics Chairman Lee Jae-yong tours the Mexico plant of Harman, an automotive electronics subsidiary acquired in 2017. / Photo = Samsung Electronics

이미지 확대보기In fact, Samsung Electronics is making swift moves, such as reorganizing its structure to search for the 'post-Harman,' demonstrating its commitment to this strategy. Despite deteriorating performance, the company has secured ample funds through asset liquidation efforts, drawing attention to potential M&A outcomes this year.

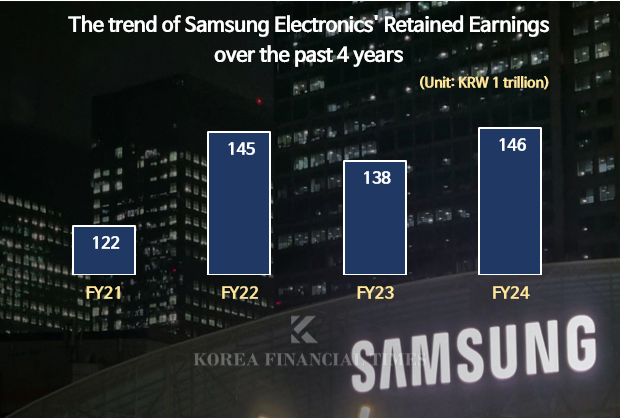

According to Samsung Electronics' business report, as of the end of last year, the company's retained earnings stood at approximately KRW146 trillion, the largest in its history. Retained earnings refer to the portion of net income that remains within the company after dividends and facility investments. This fund is used for growth and reinvestment, serving as an indicator of a company's cash management capability.

However, the fact that retained earnings have reached an all-time high can also be interpreted as the company not effectively utilizing the accumulated funds. Although Samsung Electronics made record-high R&D (research and development) expenditures and facility investments last year to enhance business competitiveness, it faced criticism for being relatively passive in the M&A market, a direct approach to securing future growth drivers.

At the end of last year, Samsung Electronics' current assets were approximately KRW 227 trillion, the highest in the past three years. Among these, cash and cash equivalents, which can be immediately utilized, amounted to about KRW 53 trillion, indicating sufficient funds for M&A activities.

The last large-scale M&A executed by Samsung Electronics was the acquisition of Harman International Industries in 2017. At that time, Samsung invested approximately KRW 9.2 trillion, marking the largest overseas M&A by a Korean company. Harman has since become a new cash cow for Samsung, recording an operating profit exceeding KRW1 trillion in 2023 and achieving its highest-ever performance last year with an operating profit of KRW 1.3076 trillion.

In addition, Samsung Electronics established an ecosystem combining the Internet of Things and home appliances through the acquisition of 'SmartThings' in 2014 and accelerated its 'Home AI' strategy this year. The company also launched 'Samsung Pay' through the acquisition of 'LoopPay' in 2015.

Source: Samsung Electronics Business Report

After Harman, Samsung Electronics continued its M&A activities by acquiring AI startup 'Sonio' through its subsidiary Samsung Medison in May last year. In July, it acquired British tech startup 'Oxford Semantic Technologies,' and in December, it increased its stake in domestic robot company Rainbow Robotics, making it a subsidiary. However, none of these deals matched the scale of Harman.

Large-scale M&A not only secures future growth engines but also demonstrates a solid financial structure, significantly impacting performance and stock prices. At Samsung Electronics' regular shareholders' meeting on the 19th of last month, shareholders voiced concerns about the lack of large-scale M&A activities since Harman.

Samsung Electronics stated, "We have been continuously pursuing M&A to secure future growth engines, but unfortunately, we have not achieved significant results." The company added, "This year, we will strive to achieve meaningful M&A in areas such as AI, semiconductors, robotics, meditech, and HVAC, and deliver visible results."

With Samsung Electronics declaring its intention to achieve tangible M&A results this year, attention is focused on the status of companies recently rumored to be acquisition targets.

Beyond Classys, there is also interest in the potential acquisition of Germany's Continental AG's automotive electronics division, which Samsung Electronics was reportedly pursuing last year. Given Harman's strengths in in-car audio and digital cockpits, acquiring Continental's automotive electronics division, which specializes in advanced driver-assistance systems (ADAS), could create synergies. However, there have been no updates on this matter for over a year.

Internally, Samsung Electronics is making swift moves, having recently elevated the 'New Business Task Force (TF)' established under the DX division for future business development to the 'New Business Team' after three years. While the New Business TF was responsible for basic planning for M&A and future business development, its elevation to a formal team suggests a more active pursuit of M&A.

A Samsung Electronics representative stated, "We have been continuously preparing for M&A to discover future growth engines," but added, "It is difficult to confirm the exact status of these efforts."

Kim JaeHun (rlqm93@fntimes.com)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)

![[DCM] 삼성FN리츠, 투자 스프레드 ‘역마진’…조달비용 절감 주력](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026030607375804919a837df6494123820583.jpg&nmt=18)

![은평구 ‘북한산현대힐스테이트7차’ 42평, 3억 내린 13억원에 거래[하락 아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026010818512300236048b718333211177233133.jpg&nmt=18)

![[그래픽 뉴스] “AI가 소프트웨어를 무너뜨린다? 사스포칼립스의 진실”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026030416113601805de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] “돈로주의 & 먼로주의: 미국 외교정책이 경제·안보에 미치는 영향”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602261105472649de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=2026022714105702425de68fcbb3512411124362.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)