The situation is not bad. This is because Senior Vice Chairman Chung is at the optimal time to show off his management skills. The group’s main businesses, including shipbuilding and electric power equipment, are in a boom period.

The problem is that the other key pillar, HD Hyundai Oilbank, is seriously underperforming. Senior Vice Chairman Chung has been involved in the management of Hyundai Oilbank since March.

The initial public offering (IPO) of HD Hyundai Oilbank is considered a long-cherished project of the group. It has attempted it three times since 2012, but has suffered defeat due to poor industry conditions etc. It does not seem easy to go public on the stock market for the time being due to the deterioration of its financial structure caused by the economic downturn.

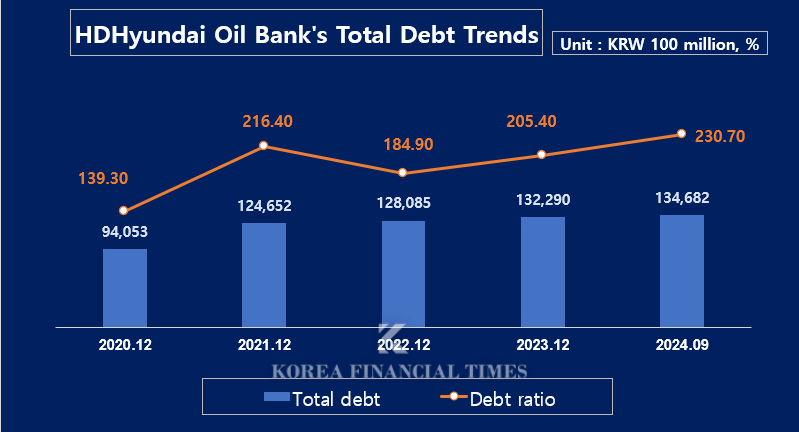

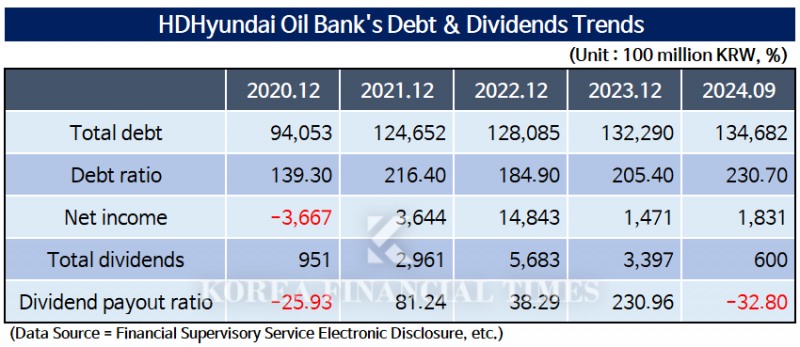

As of the end of the third quarter of this year, the debt ratio of HD Hyundai Oilbank was 230.7% based on consolidation. It has been steadily increasing: ▲139.3% at the end of 2020 ▲216.4% at the end of 2021 ▲184.9% at the end of 2022 ▲205.4% at the end of 2023.

In 2021, when the company's financial situation deteriorated rapidly, investment in the Daesan HPC project in Chungnam Province began in earnest. The HPC project is a large-scale petrochemical project in which more than KRW 3 trillion was invested in a joint venture with Lotte Chemical.

It aimed to strengthen cost competitiveness through vertical integration of oil refining and petrochemicals. However, the slump continued due to the COVID-19 situation and the oversupply from China.

The existing business, oil refining, is also seeing its performance decline due to the decline in international oil prices. In the third quarter of this year, HD Hyundai Oilbank recorded sales of KRW 7.5898 trillion and an operating loss of KRW 268.1 billion.

The deficit by business was KRW 263.4 billion for refining and KRW 71.8 billion for petrochemicals. Due to investments in gas station new businesses, the company had to pay KRW 360 billion in interest expenses alone.

Despite worsening profitability, it is not choosing to reduce dividends. Over the past four years (2020-2023), HD Hyundai Oilbank earned KRW 1.63 trillion in net profit and paid out about KRW 1.3 trillion in dividends. The dividend payout ratio is 80%.

Even when it was in deficit in 2020, it paid out about KRW 100 billion in dividends, and last year, its net profit decreased to KRW 147.1 billion, one-tenth of the previous year, but it spent KRW 339.7 billion on dividends. It also decided to pay an interim dividend of KRW 60 billion in the first half of this year.

Chairman Chung Mong-joon owns 26.6% of HD Hyundai. Senior Vice Chairman Jeong Ki-sun increased his stake in HD Hyundai from 5.26% to 6.12% this year through active stock purchases.

Gwak Horyung (horr@fntimes.com)

![[부의 지도] 이상훈 에이비엘바이오 대표, 주식자산 569% '폭증'](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021606565602265a837df6494123820583.jpg&nmt=18)

![[DQN] 국민은행, 4년 만에 순익 1위했지만···진정한 '리딩뱅크' 되려면 [금융사 2025 리그테이블]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021604342702655b4a7c6999c121131189150.jpg&nmt=18)

![최우형號 케이뱅크, IPO 이후가 본 게임…기업금융 승부수 통할까 [금융사 2026 상반기 경영전략]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=20260211150253032195e6e69892f5910240225.jpg&nmt=18)

![12개월 최고 연 5.0%…세람저축은행 '펫밀리 정기적금'[이주의 저축은행 적금금리-2월 3주]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021319014404723957e88cdd521123418838.jpg&nmt=18)

![[DCM] LG 3.61%로 조달금리 가장 높아…한화와 25bp 差 [1월 리뷰②]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026021601593602809141825007d122461258.jpg&nmt=18)

![20代의 고민, 나는 이 회사에서 임원이 될 수 있을까? [홍석환의 커리어 멘토링]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2026020321163702470c1c16452b012411124362.jpg&nmt=18)

![30조 엔의 예산, 1.8조 엔의 시늉: ‘호송선단 방식’에 가로막힌 미완의 위기 대응 [김성민의 일본 위기 딥리뷰]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025031321473103554c1c16452b012411124362.jpg&nmt=18)

![박병희 농협생명 대표, 지급보험금 증가에 손익 주춤…킥스비율 396.7% '톱' [금융사 2025 실적]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=69&h=45&m=5&simg=2025062922593508536dd55077bc25812315232.jpg&nmt=18)

![[그래픽 뉴스] 워킹맘이 바꾼 금융생활](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202602021638156443de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 매파·비둘기부터 올빼미·오리까지, 통화정책 성향 읽는 법](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601281456119025de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 하이퍼 인플레이션, 왜 월급이 종잇조각이 될까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601141153149784de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] 주식·채권·코인까지 다 오른다, 에브리싱 랠리란 무엇일까?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601071630263763de68fcbb3512411124362_0.jpg&nmt=18)

![[그래픽 뉴스] “이거 모르고 지나치면 손해입니다… 2025 연말정산 핵심 정리”](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=298&h=298&m=1&simg=202601061649137526de68fcbb3512411124362_0.jpg&nmt=18)

![[신간] 고수의 M&A 바이블](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025091008414900330f8caa4a5ce12411124362.jpg&nmt=18)

![[신간] 리빌딩 코리아 - 피크 코리아 극복을 위한 생산성 주도 성장 전략](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2025032814555807705f8caa4a5ce12411124362.jpg&nmt=18)

![[서평] 추세 매매의 대가들...추세추종 투자전략의 대가 14인 인터뷰](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2023102410444004986c1c16452b0175114235199.jpg&nmt=18)

![[신간] 이게 화낼 일인가?](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=81&h=123&m=5&simg=2026010610254801367f8caa4a5ce12411124362.jpg&nmt=18)

![[AD] 현대차, 글로벌 안전평가 최고등급 달성 기념 EV 특별 프로모션](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260106160647050337492587736121125197123.jpg&nmt=18)

![[AD] 현대차 ‘모베드’, CES 2026 로보틱스 부문 최고혁신상 수상](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20260105103413003717492587736121125197123.jpg&nmt=18)

![[AD] 기아 ‘PV5’, 최대 적재중량 1회 충전 693km 주행 기네스 신기록](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20251105115215067287492587736121125197123.jpg&nmt=18)

![[카드뉴스] KT&G, 제조 부문 명장 선발, 기술 리더 중심 본원적 경쟁력 강화](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=202509241142445913de68fcbb3512411124362_0.png&nmt=18)

![[AD]‘황금연휴에 즐기세요’ 기아, ‘미리 추석 페스타’ 이벤트 실시](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=89&h=45&m=1&simg=20250903093618029117492587736121166140186.jpg&nmt=18)